In 2021, global shipments of spinning, texturing, weaving, knitting, and finishing machines increased sharply compared to 2020. Deliveries of new short-staple spindles, open-end rotors, and long-staple spindles rose by +110%, +65%, and +44%, respectively. The number of shipped draw-texturing spindles surged by +177% and deliveries of shuttle-less looms grew by +32%. Shipments of large circular machines improved by +30% and shipped flat knitting machines registered a 109%-growth. The sum of all deliveries in the finishing segment also rose by +52% on average.

These are the main results of the 44th annual International Textile Machinery Shipment Statistics (ITMSS) just released by the International Textile Manufacturers Federation (ITMF). The report covers six segments of textile machinery, namely spinning, draw-texturing, weaving, large circular knitting, flat knitting, and finishing. A summary of the findings for each category is presented below. The 2021 survey has been compiled in cooperation with more than 200 textile machinery manufacturers representing a comprehensive measure of world production.

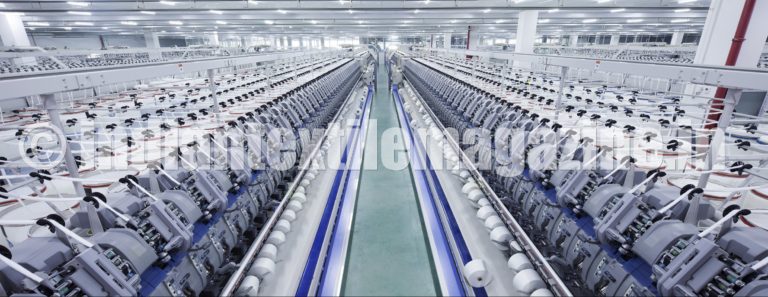

Spinning Machinery

The total number of shipped short-staple spindles increased by about 4 million units in 2021 to a level of 7.61 million. Most of the new short-staple spindles (90%) were shipped to Asia & Oceania, where delivery increased by +115%. While levels stayed relatively small, Europe saw shipments increasing by +41% (mainly in Turkey). The six largest investors in the short-staple segment were China, India, Pakistan, Turkey, Uzbekistan, and Bangladesh.

695 thousand open-end rotors were shipped worldwide in 2021. This represents 273 thousand additional units compared to 2020. 83% of global shipments went to Asia & Oceania where deliveries increased by +65% to 580 thousand rotors. China, Turkey, and Pakistan were the world’s 3 largest investors in open-end rotors and saw investments surging by +56%, +47% and +146%, respectively. Only deliveries to Uzbekistan, the 7th largest investor in 2021, decreased compared to 2020 (-14% to 12’600 units).

Global shipments of long-staple (wool) spindles increased from about 22 thousand in 2020 to nearly 31’600 in 2021 (+44%). This effect was mainly driven by a rise in deliveries to Asia & Oceania with a increase in investment of +70%. 68% of total deliveries were shipped to Iran, Italy, and Turkey.

Texturing Machinery

Global shipments of single heater draw-texturing spindles (mainly used for polyamide filaments) increased by +365% from nearly 16’000 units in 2020 to 75’000 in 2021. With a share of 94%, Asia & Oceania was the strongest destination for single heater draw-texturing spindles. China, Chinese Taipei, and Turkey were the main investors in this segment with a share of 90%, 2.3%, and 1,5% of global deliveries, respectively.

In the category of double heater draw-texturing spindles (mainly used for polyester filaments) global shipments increased by +167% to a level of 870 thousand spindles. Asia’s share of worldwide shipments increased to 95%. Thereby, China remained the largest investor accounting for 92% of global shipments.

Weaving Machinery

In 2021, worldwide shipments of shuttle-less looms increased by +32% to 148 thousand units. Shipments in the categories “air-jet”, “rapier and projectile”, and “water-jet” rose by +56% to nearly 45’776 units, by +24% to 26’897, and by +23% to 75’797 units, respectively. The main destination for shuttle-less looms in 2021 was Asia & Oceania with 95% of all worldwide deliveries. 94%, 84%, 98% of global air-jet, rapier/projectile, and water-jet looms were shipped to that region. The main investor was China in all three sub-categories. Deliveries of weaving machines to this country cover 73% of total deliveries.

Circular & Flat Knitting Machinery

Global shipments of large circular knitting machines grew by +29% to 39’129 units in 2021. The region Asia & Oceania was the world’s leading investor in this category with 83% of worldwide shipments. With 64% of all deliveries (i.e., 21’833 units), China was the favoured destination. Turkey and India ranked second and third with 3’500 and 3’171 units, respectively. In 2021, the segment of electronic flat knitting machines increased by +109% to around 95 thousand machines. Asia & Oceania was the main destination for these machines with a share of 91% of world shipments. China remained the world’s largest investor with a 76%-share of total shipments and a +290%-increase in investments. Shipments to the country rose from about 17 thousand units in 2020 to 67.6 thousand units in 2021.

Finishing Machinery

In the “fabrics continuous” segment, shipments of relax dryers / tumblers grew by +183%. All other subsegment rose by 33%-88% except dyeing lines which shrank (-16% for CPB and -85% for hotflue). Since 2019, ITMF estimates the number of shipped stenters non-reported by the survey participants to inform on the global market size for that category. The global shipments of stenters is expected to have increased by +78% in 2021 to a total of 2’750 units.

In the “fabrics discontinuous” segment, the number of jigger dyeing / beam dyeing shipped rose by +105% to 1’081 units. Deliveries in the categories “air jet dyeing” and “overflow dyeing” increased by +24% in 2021 to 1’232 units and 1’647 units, respectively.