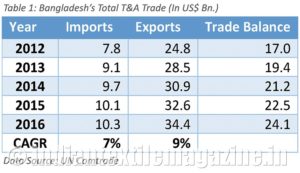

Bangladesh is the third largest exporter of textile and apparel products globally. Its T&A exports registered a positive CAGR of 9% over the last five years to reach $34.4 billion in 2016, while its imports have increased at a CAGR of 7% in the same period to reach $10.3 billion in 2016. Bangladesh’s textile and apparel trade balance recorded a surplus of around $24.1 billion in 2016.

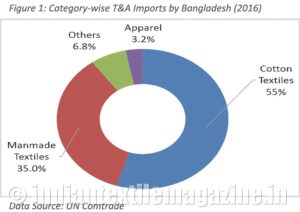

Cotton textiles is the largest imported category by Bangladesh, representing 55% of total textile and apparel imports (2016). This is followed by man-made textiles, others and apparel with a share of 35.0%, 6.8% and 3.2% respectively. Top 10 suppliers accounted for around 94% of textile and apparel imports by Bangladesh. China is the largest supplier accounting for 58% share, followed by India and Pakistan with a share of 19% and 6% respectively.

India’s T&A exports to Bangladesh

India is the second largest supplier of textile and apparel products to Bangladesh, at around $2 billion in 2016. It has registered a CAGR of 4% over the last five years.

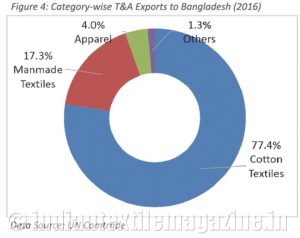

Cotton textiles is the largest category with a share of 77% in India’s T&A exports to Bangladesh. This is followed by man-made textiles and apparel having share of 17% and 4% respectively.

Bangladesh is a leading apparel exporter in the world. Its apparel exports have grown from $4.8 billion in 2000 at a CAGR of 13% to reach $32.5 billion in 2016 and is expected to grow in double digits in the future. Massive growth of apparel exports from Bangladesh will lead to higher consumption of intermediate textile products, i.e., fabric as well as yarn. Currently, Bangladesh imports its required consumption of yarn and fabric from China, India and other nations to fill the demand-supply gap. It has served as a key export market for Indian cotton and man-made textiles since a long. However, many new investments are planned in the spinning and weaving sectors of Bangladesh in the coming years with many big firms showing their interest to set up spinning and weaving units there.

Thus, Bangladesh is expected to emerge as a self-sufficient textile and apparel hub by focusing more on backward integration within the next 10 years. This is expected to lower the export opportunities for China and India. Hence, while Bangladesh is a key export market for Indian textiles, it will be important for Indian firms whose major export market is Bangladesh to look for newer markets for their exports in the coming years.

By Wazir Advisors