By B Prakash – prakash@wazir.in, and Dip Naskar – dip.naskar@wazir.in

Home Textiles market has grown over the years and continues to be in a positive space. The market has potential to grow further driven by increasing demands from hospitality and residential sectors across the globe. Our homes are becoming more personalized and stylish, so there’s a big need for home textile products that are both fancy and functional. This is driving further growth of this sector. India is not only one of the major markets for home textiles but is also one of the top suppliers globally.

Even though India is already a leader, there’s still room to increase its share in the global trade of home textiles. In this article, we’ll look at the future of the market and discuss many opportunities for India to grow even more in the thriving home textile sector.

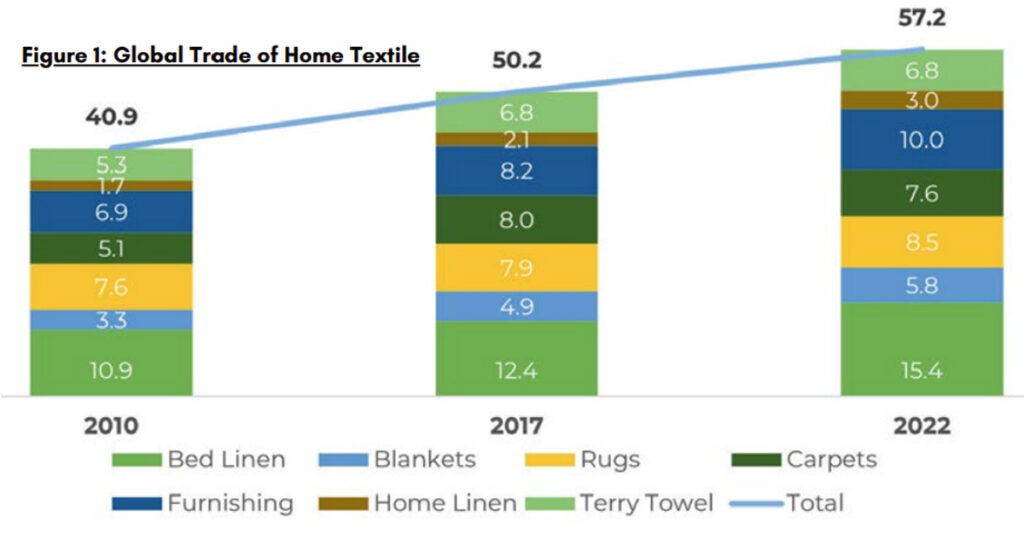

Global Expansion in Trade of Home Textile

In the year 2022, the global Textile and Apparel trade witnessed substantial growth and reached a total value of US$ 910 billion. This marked a 3% increase from the US$ 789 billion recorded in 2017. Within this expansive industry, home textile contributes a 5.5% share of the overall textile and apparel trade worldwide. In 2022 global trade of home textiles was valued at US$ 57.2 bn growing at a CAGR of 2.6% from US$ 50.2 bn in 2017. This steady growth underlines the sector’s resilience and adaptability in meeting evolving consumer demands and preferences.

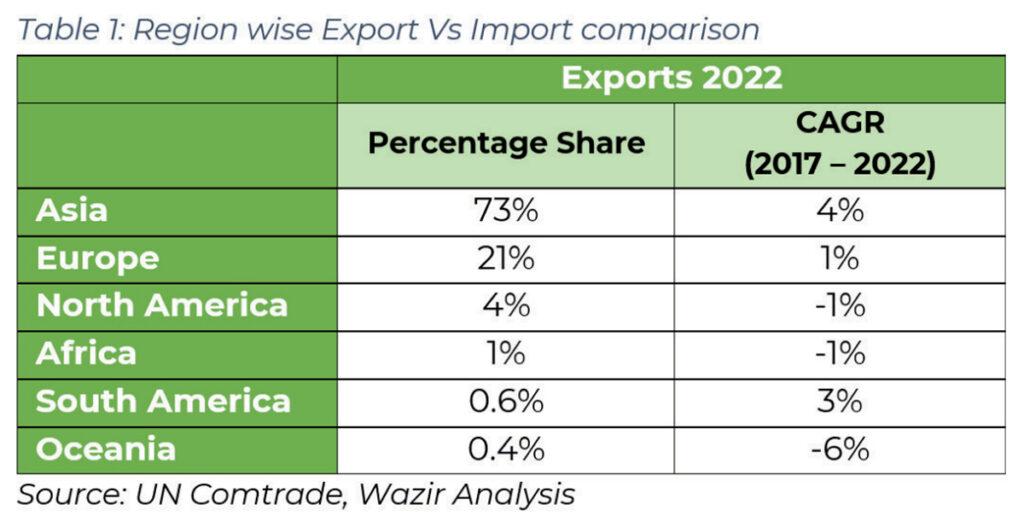

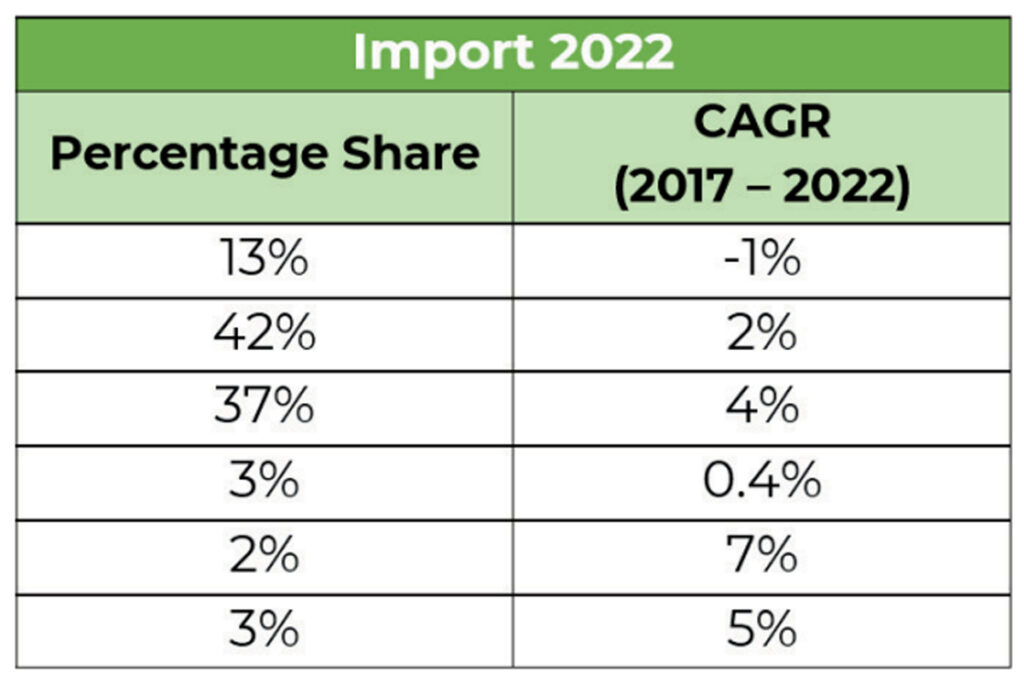

Asia Dominates in Exports While Europe Maintains Import Leadership

In 2022, Europe retained its position as the primary market for home textile, accounting for 42% of total imports, followed by North America at 37%. In contrast, Asia recorded negative growth, while South America and Oceania experienced noteworthy increases in home textile imports. On the other hand, Asia strengthened its top position in exports accounted for 73% of total global exports of Home Textile. North America, Africa and Oceania showed a significant de-growth over last 5 years.

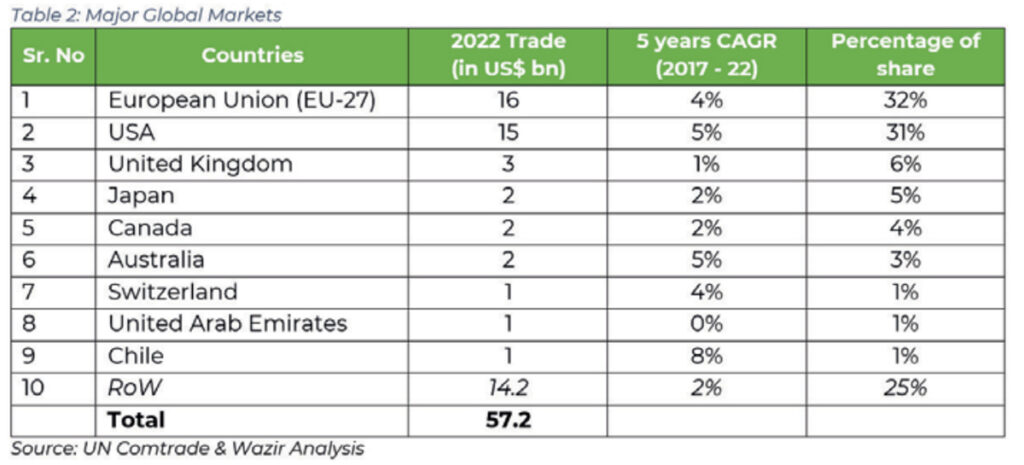

The European Union (EU – 27) with a total import value of US$ 16 billion, maintained its position as the primary market for home textiles. Followed closely by the United States, ranked second with US$ 15 billion in imports, and the United Kingdom at the third position with US$ 3 billion. Chile has entered the major market list, with an import value of US$ 1 billion and a significant growth rate of 8%. These developments indicate a shifting landscape and emerging opportunities in the home textile market.

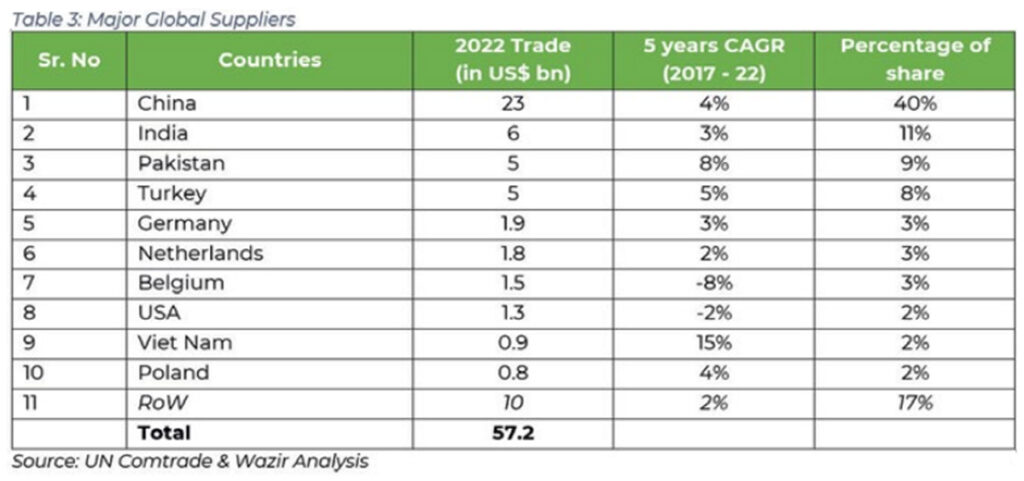

China dominated the global export market of home textile with a substantial value of US$ 23 billion, representing 40% of the total global export. Followed closely by India and Pakistan, who accounted for 11% and 9% of the total global export share, respectively. An analysis of the 5-year CAGR reveals significant growth in countries like Vietnam at 15% and Pakistan at 8%, underscoring their noteworthy contributions and promising growth prospects within the Asian region. However, Belgium and the USA showed a negative growth trend, potentially attributed to a shift in industry locations and the pursuit of cost-effective skilled labour.

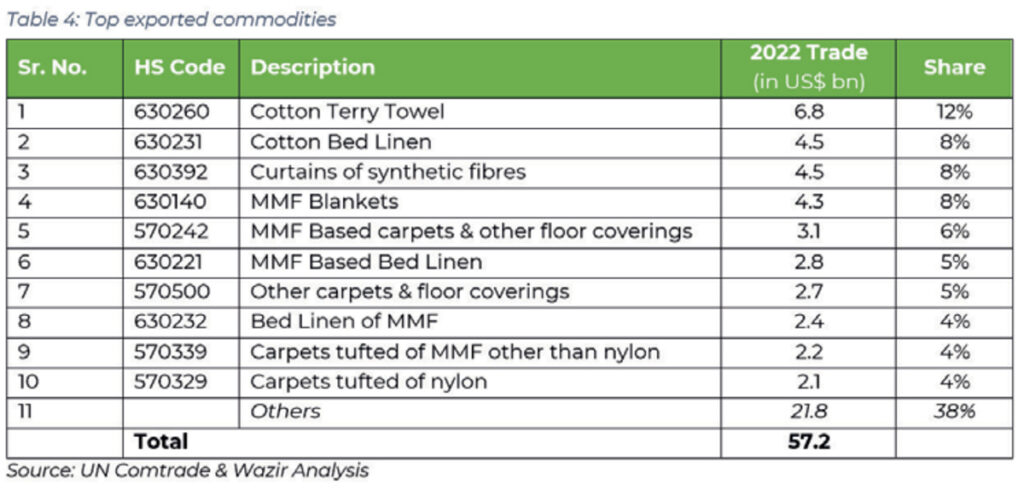

Cotton Terry Towels was the leading exported commodity in 2022, with a value of US$ 6.8billion, constituted a 12% market share. Followed closely by cotton bed linen & curtains made from synthetic fibres.

India’s Export has grown by 3% over the last 5 years

India has consistently been a significant provider of home textile products worldwide. After China, India’s exports in 2022 reached a value of US$ 6 billion at a CAGR of 3% from 2017, comprised an 11% share of the total global exports.

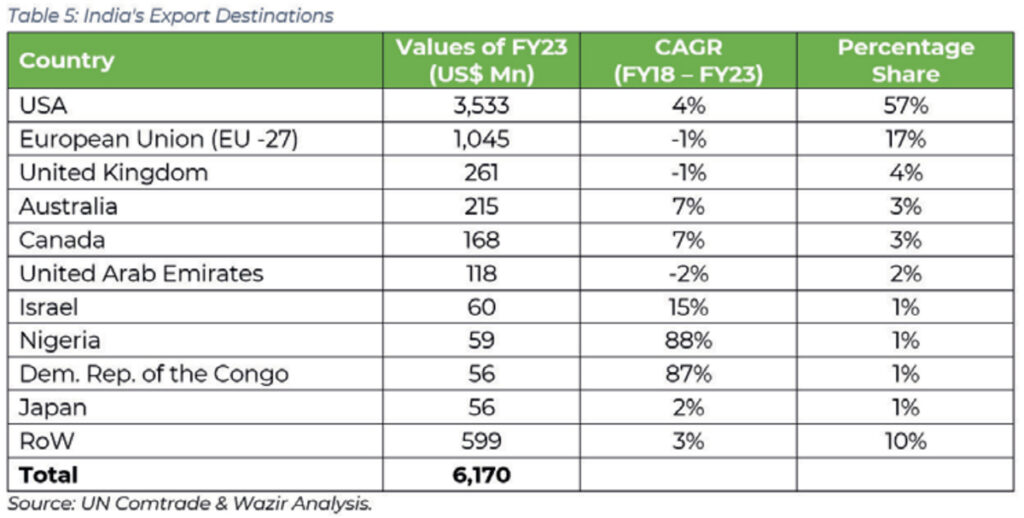

Although the United States and the European Union (EU 27) remained the key markets for India, emerging destinations such as Israel, Nigeria, and Congo have entered the top 10 exporting destinations, exhibiting impressive export growth of 15%, 88%, and 87%, CAGR respectively, over the past five years. Australia and Japan, accounted for 3% and 1% of India’s total home textile exports, however, there is potential to evolve Australia and Japan into significant export hubs by capitalizing on FTAs.

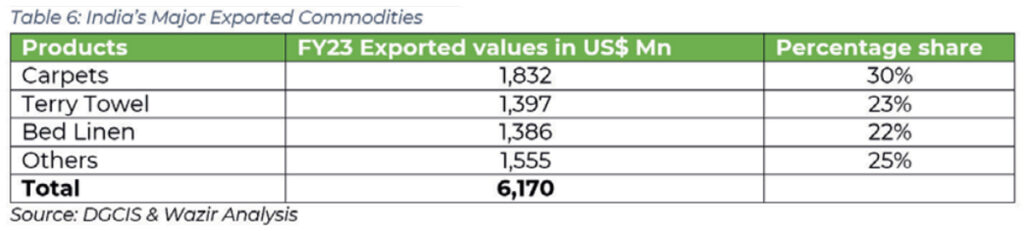

Carpets continued to be the largest exported commodity from India in home textile with a 30% share of total exported commodities. It is followed by terry towel and bed linen with 23% and 22% of the export share in home textile segment.

Tapping Export Opportunity in Selected Products

India is trying to grab the opportunity of the rise in demand for MMF-based commodities and has done well to find significant growth in the same segment. However, more initiatives need to be taken to gain market share by replacing market leaders like China.

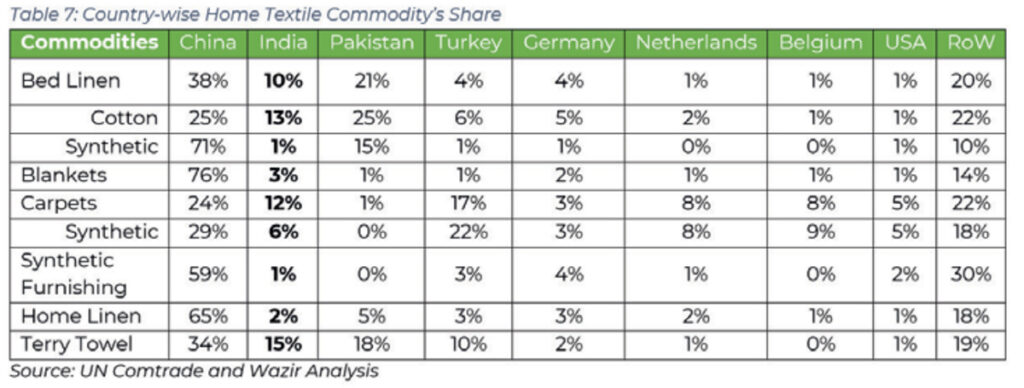

Although India is one of the leading suppliers of home textile in global trade, it has a potential scope to grow and expand further in market share in various commodities some of which are majorly traded worldwide, like in bed linen India has only 10% market share, it has more room for growth, especially in synthetic bed linen, where India’s share is only 1% of the total globally exported synthetic bed linen.

Additionally, in synthetic carpets and furnishing India has only 6% and 1% share respectively, also for home linen India’s share is only 2% of the total home line exported globally, giving India a good scope to expand its market share. Since, globally the demand of MMF based commodities is increasing India has a good opportunity to align its export products as per global requirements and capitalize more on the market share.

Along with the Exports India’s Domestic Market Growth is Significant

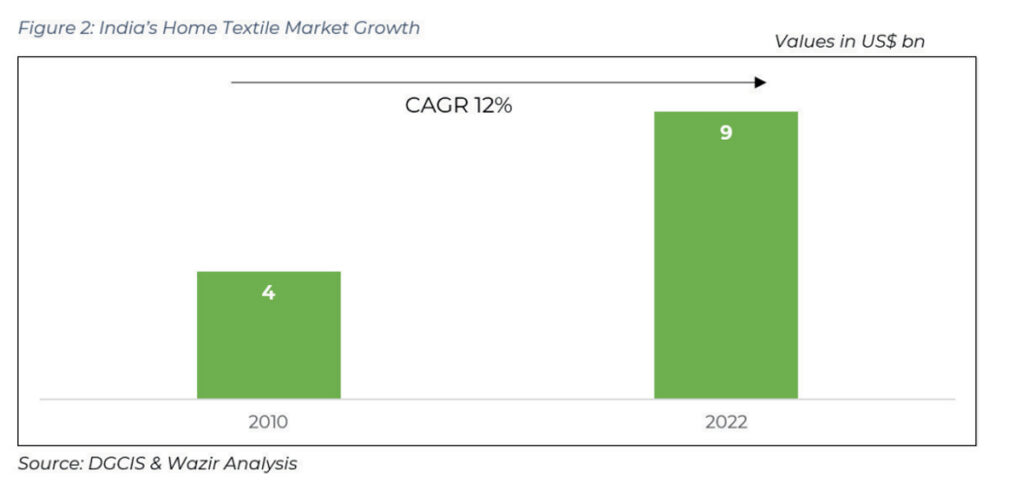

India’s domestic market has shown steady growth in the home textile segment, from US$ 4 billion to US$ 9 billion it has grown with a CAGR of 7% over the past 12 years. The change in market dynamics has made India not only one of the major exporters but also one of the largest consumers, with major players like Welspun and Trident along with other significant players pushing boundaries of their production capacities to supply the ever-growing demand.

The emergence and expansion of stores such as Fab India, Home Stop, and Home Centre have provided domestic manufacturers with an improved platform to reach a broader audience. This is facilitated by a well-organized supply chain that entails minimal risks compared to exporting. Additionally, e-commerce retailers like Amazon, Flipkart, and Snapdeal have experienced significant growth in the past five years, further contributing to the flourishing landscape for domestic manufacturers. Numerous brands have acknowledged the potential within the home textiles sector and are making substantial investments to promote and broaden their audience reach. Retail giants like IKEA, H&M Home, and Home Depot are trailblazers in this domain, renowned for their expansive stores featuring customer-centric products. These retailers strategically establish their sourcing and design offices in Asian countries to expedite product development. The innovative strategies and investments made by these entities serve as evidence of the anticipated growth in the industry. India has the opportunity to capitalize on and become the major manufacturing hub for these global brands.

The other growth drivers home textile market includes rising disposable income, changing lifestyle trends, increasing hospitality sector demand and increasing awareness of home décor.

Conclusion

Indian manufacturers have the opportunity to enhance investment and emphasize manufacturing excellence by leveraging government schemes such as PLI. By concentrating on global demand and capitalizing on the ‘China +1’ trend, India has the opportunity to increase an additional US$ 10 bn of exports if we could capture 10% of the market share from China and reach 20% market share from present 11% share of total global home textile export.

From tapping into the burgeoning opportunities in both the International & Domestic landscape to embracing sustainable practices, the home textile industry in India stands at the crossroads of innovation and growth. As we navigate through the intricacies of the home textile industry, we unveil a world of possibilities and potential that awaits those ready to weave their narrative into the fabric of this dynamic and burgeoning market.