The unpredictable volatility in global economies impacted the textile markets, and demand in major consuming economies turned cautious and slower. Many producers across the globe shifted or set up new manufacturing bases at low-cost centres, mostly in Asian countries.

The unpredictable volatility in global economies impacted the textile markets, and demand in major consuming economies turned cautious and slower. Many producers across the globe shifted or set up new manufacturing bases at low-cost centres, mostly in Asian countries.

The competitiveness of Chinese exports eroded as the Chinese Government made Yuan market dominated. As a result, Yuan strengthened by five per cent, while other major Asian currencies depreciated by 5-9 per cent against the US dollar. In addition, labour costs also impacted cost structures in China.

During FY 2011-12, cotton markets continued to be an area of significant interest. Encouraged by high prices in cotton marketing year FY 2010-11, farmers planted about eight per cent more acres for the next season. However, at the time of the harvest, demand prospects in major consuming countries faltered.

Downstream players in major processing centres across the globe lowered operating rates, leading to huge stockpiles. Consequently, cotton prices plunged by 10 per cent in contrast to 100 per cent increase witnessed in FY 2010-11. The Chinese reserve purchases by the Government were also not enough to sustain the surge in supplies in most producing countries.

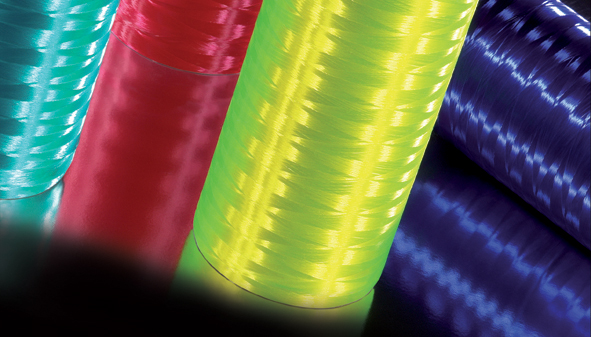

The high volatility in cotton prices and ambiguous outlook forced downstream players to opt for polyester due to lesser price volatility and greater reliability of steady supplies of polyester. Consumption of polyester fibre and yarn during 2011 thus increased by seven per cent to 39 mmt.

In 2011-12, polyester prices increased by five-six per cent over the previous year, mainly owing to cost push from feedstock and energy. The unfriendly demand scenario kept markets unreceptive, and pressure on margins increased, lowering delta by 24-30 per cent. Producers turned cautious to keep plant operations in control to avoid piling of inventories.

Polyester capacity additions were predominantly seen in PFY, accounting for about 70 per cent of the total four mmt. PSF witnessed restart of some idled capacity owing to the surge in demand, arising from fluctuations in cotton prices and better margins in PSF.

It is expected that by 2015 polyester capacity would increase by about 12 mmt, largely in PFY. Most of these capacity additions of about 9 mmt are planned in China. At the same time, global demand is likely to grow by 7 mmt by the same period.

Domestic operating environment

India continued to hold a crucial position in global textile industry, owing to its advantages of adequate availability of raw materials, relatively lower conversion costs, skilled manpower and favourable demographics. Cotton and polyester accounted for around 92 per cent of the total fibre requirements of Indian textile mills.

As per government estimates, cotton and man-made fibre consumption in India is in the ratio of 59:41 as against 40:60 globally. The lower per capita fibre consumption in India of around five kg as against the global average of 11 kg indicated huge potential for expansion of fibre consumption. Other major demand drivers included rising disposable income and working population, emerging non-apparel applications of fibre and industry-friendly government policies.

In FY 2011-12, the textile industry was impacted due to volatile cotton markets. Within a span of around five-six months, the international and domestic cotton prices saw historic peak and subsequently a steep fall.

The uptrend was primarily due to shortage of cotton availability across the world and certain government policies on cotton and cotton yarn exports, which were not congenial for textile industry growth. Consequently, the industry resorted to panic buying and stocked cotton.

But, with the beginning of declining trend in cotton prices, the industry faced problems in sourcing of cotton, impacting the downstream demand as well. End-users moved into strict wait-and-watch mode, and the textile industry faced huge pile-up of unused cotton and cotton yarn inventory, leading to severe stock losses. Man-made fibres, especially polyester fibre and yarn, fared relatively better as volatility in prices of polyester was much lower as compared to cotton. Major textile production centres in Andhra Pradesh, Tamil Nadu and some northern States faced severe power shortages, adversely affecting the output and profitability of mills. Labour shortage was also prominent during the year.

But, with the beginning of declining trend in cotton prices, the industry faced problems in sourcing of cotton, impacting the downstream demand as well. End-users moved into strict wait-and-watch mode, and the textile industry faced huge pile-up of unused cotton and cotton yarn inventory, leading to severe stock losses. Man-made fibres, especially polyester fibre and yarn, fared relatively better as volatility in prices of polyester was much lower as compared to cotton. Major textile production centres in Andhra Pradesh, Tamil Nadu and some northern States faced severe power shortages, adversely affecting the output and profitability of mills. Labour shortage was also prominent during the year.

Government restrictions on raw cotton and cotton yarn exports were witnessed along with some proactive measures to assist the domestic and export community against the backdrop of weakened demand and continuous economic uncertainties from the West. The Technology Upgradation Fund Scheme (TUFS) was restructured and higher allocations were provided. The high potential growth segment, technical textiles, was included within its ambit. The Textile Ministry proposed to make TUFS a part of the 12th Plan beginning from April 2012.

The Government also announced Rs. 900-crore incentives for exporters in October 2011. The Focus Product Scheme was extended to include polyester textured yarn (PTY), fully drawn yarn (FDY) and polyester textile grade chips.

A Special Focus Market scheme was introduced, which provided additional one per cent duty credit for exports to specific countries. The Government scrapped the DEPB scheme and introduced the revised duty drawback scheme with effect from October 1, 2011. Further, the Government approved 21 new integrated textile parks in nine States at a project cost of Rs. 2,100 crores over a period of 36 months. These parks are expected to leverage an investment of over Rs. 9,000 crores and generate over four lakh jobs.

RIL’s performance

Reliance Industries Ltd. (RIL) continued to hold top rankings in polyester and feedstock markets, constantly reaping the benefits of backward integration. RIL’s consolidated polyester capacity stood at 2.4 mmt. According to PCI, RIL held the first rank in polyester fibre and filament capacity, fifth rank in PX and 8th in PTA and MEG.

Reliance Industries Ltd. (RIL) continued to hold top rankings in polyester and feedstock markets, constantly reaping the benefits of backward integration. RIL’s consolidated polyester capacity stood at 2.4 mmt. According to PCI, RIL held the first rank in polyester fibre and filament capacity, fifth rank in PX and 8th in PTA and MEG.

RIL catered to 38 per cent of the domestic market and exported to over 100 destinations.

During FY 2011-12, domestic polyester demand grew moderately at two per cent over FY 2010-11. The momentum was led by the 17 per cent growth in PET followed by 2.8 per cent growth in PFY.

RIL contributed to 25 per cent of the domestic PFY demand of around 2.2 mmt, 69 per cent of the domestic PSF demand of 0.8 mmt and 47 per cent of the domestic PET demand of 0.5 mmt. Production volumes of polyester declined by 2.4 per cent to 1663 kt. PFY production decreased by 5.5 per cent to 695 kt, while PSF and PET production were almost steady at 615 kt and 352 kt.

In case of polyester feedstock, domestic PTA demand during the year was around 3.5 mmt, down by three per cent from the previous year. MEG domestic demand was around 1.7 mmt, up by four per cent and PX domestic demand was 2.2 mmt, up by seven per cent compared to the previous year. Fibre intermediates production (PX, PTA and MEG) of 4,756 kt marked an increase of five per cent and PX production increased by nine per cent to 2004 kt, PTA production was up by two per cent at 2,069 kt, while that of MEG was marginally higher at 683 kt.

During the year, the company enhanced its market reach through improved customer interaction at various open forums and through electronic and print media. It also developed hygiene products, such as hydrophilic spunlace fibre which has better moisture absorbability and is used for high absorbent hygiene products, micro spunlace fibres for extra soft hygiene applications and trilobal spun-lace fibres. It also launched a specialised pillow for relief from neck pain while sleeping.

RIL innovations for textile industry during the year included Recosilk, a specialised thread for embroidery applications, and Recron Bind and a product that increases knitted fabric structure strength. RIL’s contribution to nature protection led development of products to substitute harmful carcinogenic asbestos in roofing applications, siliconised fibres for soil stabilisation and fine denier fibres for the construction industry.

Future outlook

The global feedstock demand is expected to rise in line with the polyester production. MEG demand is expected to grow by six mmt by 2015, while capacity additions are also foreseen at six mmt. This will assist plant operating rates favourably. PTA demand is expected to rise by 14 mmt by 2015, while capacity additions are expected to rise sharply by 32 mmt. The PTA capacity addition will require large investments in feedstock PX, of which only 13 mmt is planned till 2015. The large PTA addition may lead to price moderations, but a constraint in PX supplies will determine the operating rates of these new plants and the subsequent market balance.

Demand growth of 6.4 per cent in PET has been estimated during 2012, predominantly in the Asia/Pacific region. PET capacity additions, however, will rise above the demand growth and are likely to pressure operating rates. About 60 per cent of this capacity addition is expected in China.

As per the recent Fitch Ratings report, the outlook for the Indian textile industry for FY 2012-13 is expected to be stable for synthetic textiles and negative to stable for cotton textiles, depending on the segment of the value chain. The study estimates that cotton textiles will face challenges of slower demand pick-up and loss of margins before an anticipated recovery from the fall in cotton prices.

Synthetic textiles will benefit from substitution of higher priced cotton products and a greater demand for blended textiles. As per Technopak estimates, the Indian textile industry, over the long term, has a potential to grow to $220 billion by 2020 from its current size of around $80 billion, at a CAGR of around 10-11 per cent. Such ambitious targets will be led by a significant incremental fibre demand, and polyester is likely to account for the majority share, given the limitations and restrictions associated with natural and other fibres.