In spite of an increase in production in 2011 by Italian textile machinery manufacturers, forecasts remain cautious for the current year.

In spite of an increase in production in 2011 by Italian textile machinery manufacturers, forecasts remain cautious for the current year.

Provisional figures for 2011 for Italy’s textile machinery sector showed a further increase in manufacturing production and exports following a good recovery in 2010. This after the widespread recession in 2009 hit machinery manufacturers hard.

The value of Italian textile machinery production for 2011 registered a 9 per cent increase compared to 2010, from 2.4 to 2.6 billion euros. A similar increase was recorded for exports (+10 per cent), valued at just over 2.1 billion euros.

Exports remain the driving force behind the sector’s growth in Italy. The dynamism of major textile markets, combined with the ability of Italian machinery manufacturers to assert themselves on a global scale, contributed to sustained growth in exports. Almost 25 per cent of the sector’s sales abroad are directed to China, with Asian markets generally accounting for 50 per cent of all foreign sales.

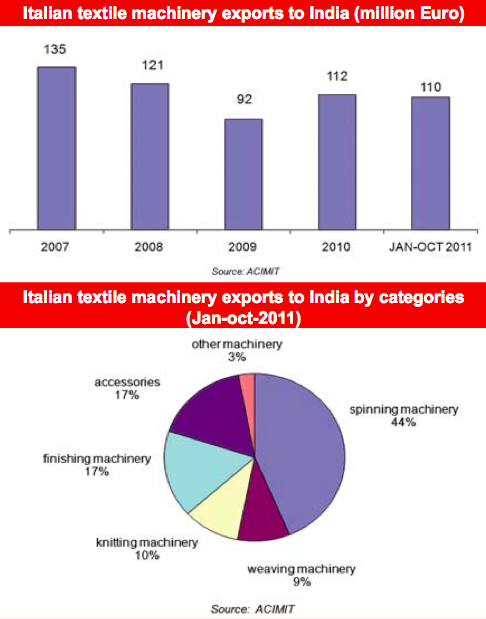

The latest National Institute of Statistics data on Italian exports for the first 10 months of 2011 show significant growth in all markets – European (France +44%, Germany +56%); non-European (Russia +88%, Turkey +83%); American (United States +81%, Brazil +15%, Peru +15%); and Asian (Bangladesh +49%, China +11%, South Korea +53%, Japan +30%, India +22%, Indonesia +58%). These are all countries towards which Italian exports had already experienced strong growth in 2010 as well.

The latest National Institute of Statistics data on Italian exports for the first 10 months of 2011 show significant growth in all markets – European (France +44%, Germany +56%); non-European (Russia +88%, Turkey +83%); American (United States +81%, Brazil +15%, Peru +15%); and Asian (Bangladesh +49%, China +11%, South Korea +53%, Japan +30%, India +22%, Indonesia +58%). These are all countries towards which Italian exports had already experienced strong growth in 2010 as well.

On the other hand, demand has remained especially weak from the domestic market. In Italy, as throughout the European Union in general, current economic uncertainty is hindering a recovery in investments, even in the textile industry.

In spite of the growth experienced in 2011, Italian machinery manufacturers remain extremely cautious for the current year. “Global demand for textile machinery began slowing last summer. The latter months of 2011 and the beginning of this year have confirmed a setback in new orders for many producers. This is a consequence of the current difficult economic condition,” says Sandro Salmoiraghi, ACIMIT President.

“The positive outcome of ITMA Barcelona, the industry’s primary trade fair held last September, provided us with some reasons to be optimistic. However, many deals which had been initiated at the trade fair have not yet been finalized, given the state of uncertainty hovering over the future outlook of the markets. Let’s just say 2012 hasn’t started off with the best of prospects. The evolution of the economy over the course of the next quarter will provide a more accurate indication of what the future holds for us, whether to expect a recovery or renewed stagnation”, he adds.

According to Salmoiraghi, the economic slowdown has also affected and currently affects developing countries as well, including their textile sector. The drop in consumer spending in developed markets has penalized major garment exporting countries, above all China. In 2012 it will be difficult to find markets capable of significantly increasing their installed production capacity.

In hard times such as these, institutions must be as supportive as ever. “Roughly 80% of production in our sector is directed at foreign markets,” attests Salmoiraghi. “This high propensity towards exports, combined with the comparatively small size of our manufacturers, means that they absolutely must be supported in order to face up to international competition.”

Salmoiraghi’s appraisal for the reconstruction of the ICE, the Italian institute for foreign trade, is accompanied by the hope that the agency will rapidly return to full-scale operations.

He concludes: “The ICE is an essential element in a mosaic that must be completed with a greater level of support from the banking system, which many Italian SMEs have called upon to ease access to credit during these difficult times.”