The Indian textile industry has its important place in the economy of the country. It contributes around four per cent to the country’s GDP and provides direct and indirect employment to approximately 105 million people. India is the currently the second largest manufacturer and exporter of textile and apparel, after China. The Indian domestic market is estimated to be around $84 billion. T&A exports of India were worth around $40 billion in 2016, with a share of around five per cent in the global T&A trade. The Indian domestic and export market is poised for double-digit growth owing to structural changes in the country and international events shaping the global trade. This article explores the macro-economic trends affecting the consumer landscape and manufacturing scenario in India and investment opportunities in the textile industry.

Growing domestic market

India has a strong population base with the largest Gen Y population in the world, coupled with a growing economy. Around 65 per cent of Indians are under the age of 35 and as this population joins the workforce, they will have increased the spending power that will ultimately lead to increased domestic demand for textile and apparel items. Increasing women workforce is another major factor boosting the apparel market in the country.

Urbanization and rurbanization are other important factors shaping the Indian consumer spending habits. Citizens are migrating from rural to urban areas in search of job opportunities and better amenities, while steps are also being taken to improve facilities in rural India. The ballooning middle class is also boosting Indian consumption patterns. The number of households with an annual income of more than $14,000 has increased at a CAGR of 11 per cent since 2005 and is expected to increase at the same rate for the next 10 years. The number of households earning an annual income ranging from $4,000 – $7,000 grew from 11 million in 2005 to 55 million in 2016 and is expected to reach around 95 million by 2025.

Owing to the above factors among many, the buying habits of Indian customers have changed over the years. Increasing brand awareness and penetration of brands to tier-II, tier-III and tier-IV cities have largely contributed to a shift in buying pattern from need-based to aspirational buying. The current apparel market of India is estimated to be around $63 billion out of the $80 billion domestic T&A market and is expected to grow at a CAGR of 12 per cent for the next 10 years to become $180 billion.

Positive outlook in international market

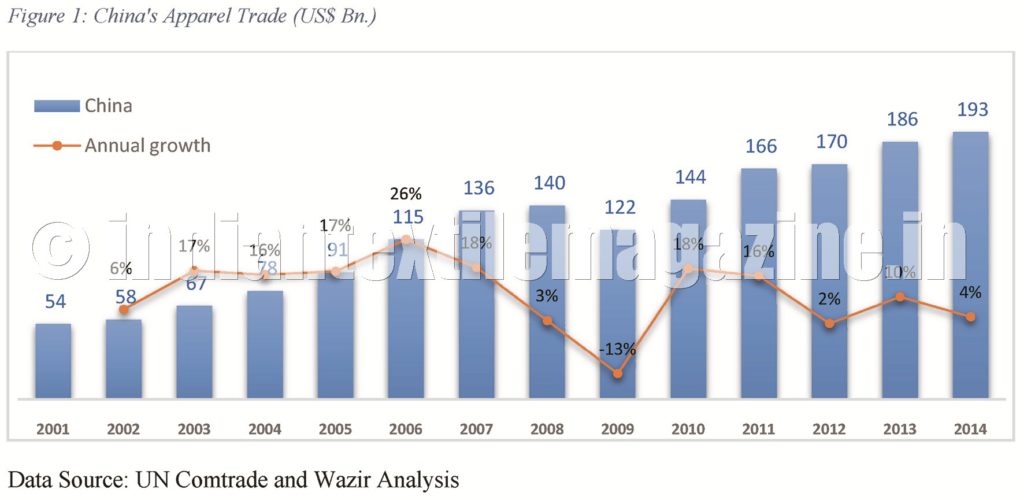

The Indian textile industry is seeing a positive growth not only in the domestic market but also in the international market. Currently, India has a share of around five per cent in global T&A trade, which stood around $765 billion in 2016, while China has a share of 36 billion. Over the past years, China has taken advantage of its vast human resource, low manufacturing costs and large-scale infrastructure to become a manufacturing hub for the world. This has allowed China to have high year-on-year growth of its apparel exports till 2006. However, the growth has slowed down since then and is showing a declining trend as shown in the figure.

China’s labour pool is shrinking, exerting pressure on wages. Apparel manufacturing, being a labor-intensive industry, has been facing tremendous pressure because of rising wage cost. China is also shifting its focus to more value-added segments like aerospace, nanotechnology, robotics, etc. Moreover, the Chinese apparel market is expected to grow at a CAGR of 10 per cent over the next few years and become $615 billion market by 2025 from the current market size of $237 billion. The focus of the Chinese industry is expected to shift from exports to catering to the increasing domestic market. Given the shift in Chinese focus, India has the opportunity to expand its presence in the international market as well.

Changing landscape of Indian economy

The Indian Government has been providing direct and indirect support to the textile sector. The Government has allowed 100 per cent FDI in the retail sector under the automatic route with a clause to source around 30 per cent of the merchandize locally. This has not only attracted international brands to the domestic market but has also boosted domestic manufacturing. The Government decision to roll out Goods and Service Tax (GST) from the current financial year will catalyze in making the unorganized segment of this industry more organized and will bring it under the GST ambit to avail input tax credit. This will help in streamlining the Indian textile value chain. The textile industry has also been recognized as a priority sector under the ‘Make in India’ program launched by the Prime Minister, Mr. Narendra Modi.

Apart from this, direct support is also provided by both the Central and State Governments. A lot of schemes and policies have been introduced to support investment in this sector.

Major Central Government schemes that are exclusively available for the textile sector are given below:

* The Amended Technological Upgradation Fund Scheme (ATUFS) provides capital subsidy to weaving, processing, garmenting and technical textiles sector for plant and eligible machinery in the range of 10-15 per cent.

* The Scheme for Integrated Textile Parks (SITP) provides support in PPP mode to address the infrastructure gap in the textile industry by creation of textile parks with suitable infrastructure for textile manufacturing such as ETPs, uninterrupted power supply, road and connectivity, etc.

* The Integrated Processing Development Scheme (IPDS) aims to facilitate the textile sector to become globally competitive using environmentally friendly processing standards and technology by providing grant up to 50 per cent of the project cost (excluding land cost) for projects with Zero Liquid Discharge Systems and Rs. 10 crores for projects with conventional treatment systems.

Recently, the Central Government also announced a special package for apparel and home textiles. The package includes increase in capital subsidy, income-tax rebate to manufacturers and change in labor laws.

Apart from the above-mentioned schemes, many State Governments have also introduced textile policies to attract investments by providing subsidies and requisite support to the industry. To name a few, power subsidy is being provided by Gujarat, capital subsidy is being provided by Maharashtra, freight subsidy by Haryana, etc. States that had limited presence in this sector are also attracting investments by providing subsidies. For example, employment generation subsidy is being provided by Jharkhand and training subsidy by Odisha and Jharkhand. Other States like Assam are in the process of introducing a dedicated textile policy to boost investment in this sector.

Competitive manufacturing landscape

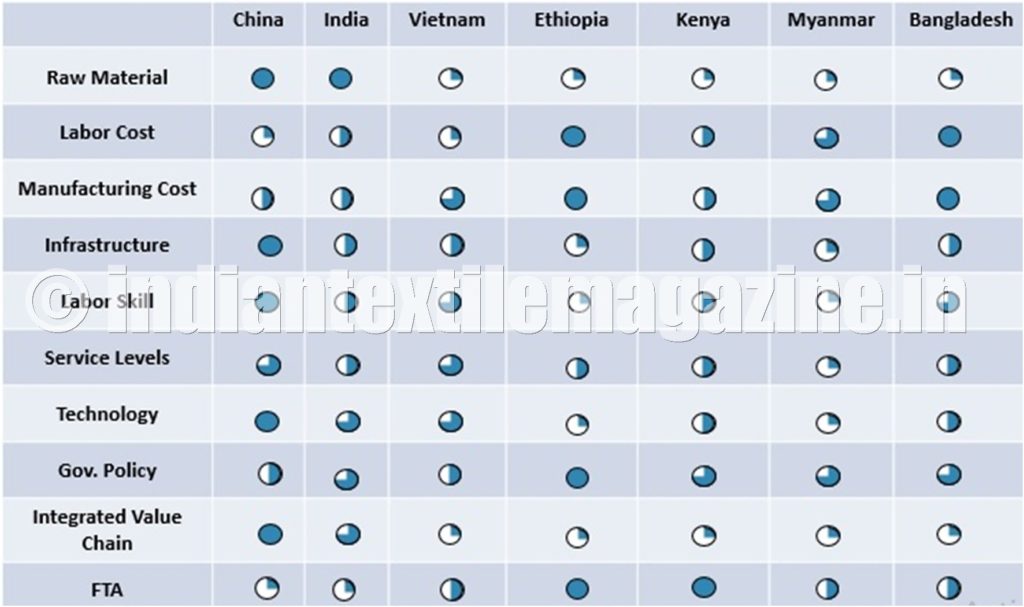

India enjoys several advantages when it comes to textile and apparel manufacturing compared to competing nations like China, Vietnam, Bangladesh, Ethiopia, Myanmar, Kenya and others.

* Abundant availability of raw material: India is the largest producer of cotton and the second largest producer of polyester in the world, after China. Large-scale availability of important textile fibres has helped the development of downstream manufacturing value chain – yarns, fabrics and garments.

* Manpower availability, quality and cost: Under the ‘Make in India’ campaign, the Government has also put a lot of focus on increasing the skill level of the workforce to not only ensure the quantity but also the quality of the workforce. The Integrated Skill Development Scheme (ISDS) is a flagship programme of the Ministry of Textiles under which a target to train 15 lakh candidates has been set. Other skill development programmes are Deen Dayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY), Pradhan Mantri Kaushal Vikas Yojana (PMKVY), Recognized Prior Learning (RPL), etc.

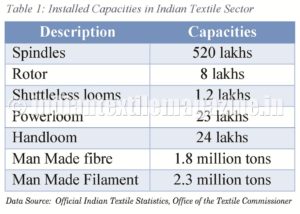

* Large existing manufacturing set-up: India has well established production facilities in the textile value chain from fiber to the finished products (apparel, home textiles and technical textiles). India has the best and the largest state-of-the-art spinning capacities in the world.

There are around 74 Integrated Textile Parks dedicated for manufacturing textile and apparel items. Apart from the textile parks sanctioned by the Central Government, many State Governments have also initiated development of such parks. The West Bengal Government is planning to set up 12 parks dedicated to textile and apparel. States like Gujarat, Maharashtra, Telangana and Andhra Pradesh are also working on similar plans, with the Maharashtra Government providing a subsidy of 9 per cent for setting up of textile parks in the State.

Investment opportunity in textiles industry

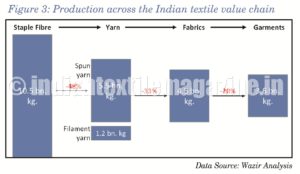

Given the macro-economic trends and international events shaping the Indian and global economy, the Indian textile industry is looking at vast opportunities in this sector. Though the Indian textile industry has a strong presence in the entire value chain, there are still some structural weaknesses in the manufacturing value chain.

As we proceed downstream in the value chain, the manufacturing capacities continue to reduce, thereby losing out on the opportunity of value addition. A significant amount of value addition opportunity is lost because of exports of unfinished goods, viz., raw fiber, yarn and greige fabrics.

The fundamental issue within the value chain lies with the fabric manufacturing and processing sector, which suffers from lack of capacity and use of obsolete technologies to an extent that the upstream and downstream processes are not able to utilize their full potential. Fabric manufacturing in India is mostly unorganized, preventing the segment from taking advantage of economies of scale. Moreover, the Government initiatives towards environmental protection have hit the processing industry, leading to closure of many units, especially in Tirupur, Sanganer and Pali as they were not environment-compliant.

It is important to realize that in order to make strong positioning in the global market, there is a need to bring about structural transformation in the value chain. Vast opportunities lie in high-end weaving, fabric processing and manufacturing of finished products, viz., apparel and home textiles. The Government has realized the same and has been providing support through schemes like ATUFS, IPDS, etc.

In order to ramp up the weak links in the value chain, investments are required from both international companies and domestic players. Countries like China, South Korea and Taiwan among others who have become global players in fabric manufacturing and processing. India can go for joint ventures with these players to bring the requisite know-how and economies of scale in the country. India can also look to bring in technical experts from these countries to reduce the learning curve in these segments.

In today’s scenario, the Indian textile industry stands a chance to gain in a big way from the global and domestic opportunities by exploiting the favourable business environment being developed in the country. The combined efforts of the stakeholders can be seen to bear fruitful results. India currently ranks 39 in the Global Competitive Index rising 16 ranks from the previous year’s position of 55, as per the World Economic Forum.

In World Bank’s Ease of Doing Business ranking India ranks 130, but is expected to break into the top 100 this year. India is now among the top 10 destinations for foreign direct investment (FDI) as per the World Investment Report by the United Nations. Following the structural changes happening in the country, India has gained attention of the international community and is on the path of becoming a global investment destination and a manufacturing hub.

By Sanjay Arora & Manjulika Poddar, Wazir Advisors Pvt. Ltd.

The author can be reached at sanjay@wazir.com for any queries or further details