After a period of the Covid-19 pandemic induced lull, there is some good news filtering in for the textile industry. The Union Cabinet chaired by the Prime Minister, Shri Narendra Modi has given its approval for continuation of Rebate of State and Central taxes and Levies (RoSCTL) with the same rates as notified by Ministry of Textiles vide Notification dated 8th March 2019, on exports of Apparel and Garments (Chapters-61 & 62) and Made-ups (Chapter-63) in exclusion from Remission of Duties and Taxes on Exported Products (RoDTEP) scheme for these chapters. The scheme will continue till 31st March 2024.

The other Textiles products (excluding Chapters-61, 62 & 63) which are not covered under the RoSCTL shall be eligible to avail the benefits, under RoDTEP along with other products as finalised by Department of Commerce from the dates which shall be notified in this regard.

Continuation of RoSCTL for Apparel/Garments and Made-ups is expected to make these products globally competitive by rebating all embedded taxes/levies which are currently not being rebated under any other mechanism. It will also provide a level playing field for Indian textile exporters, apart from providing an opportunity for start-ups and entrepreneurs to create lakhs of jobs.

Tax Refund for Exported Products

In addition, to import duties and GST which are generally refunded, there are various other taxes/duties that are levied by Central, State and Local Government which are not refunded to the exporters. These embedded taxes and levies increase the price of Indian Apparel and Made-ups and make it difficult for them to compete in the international market.

Realizing the importance of refund of embedded taxes, cesses and duties, the Ministry of Textiles first launched a scheme by the name of Rebate of State Levies (ROSL) in 2016. In this scheme the exporters of apparel, garment and made-ups were refunded embedded taxes and levies through the budget of the Ministry of Textiles. In 2019, the Ministry of Textiles notified a new scheme by the name Rebate of State and Central Taxes and Levies (RoSCTL). Under this scheme, the exporters are issued a Duty Credit Scrip for the value of embedded taxes and levies contained in the exported product. Exporters can use this scrip to pay basic Customs duty for the import of equipment, machinery or any other input.

Just one year after launch of RoSCTL the Covid-19 pandemic set in and it has been felt that there is a need to provide some stable policy regime for the exporters.

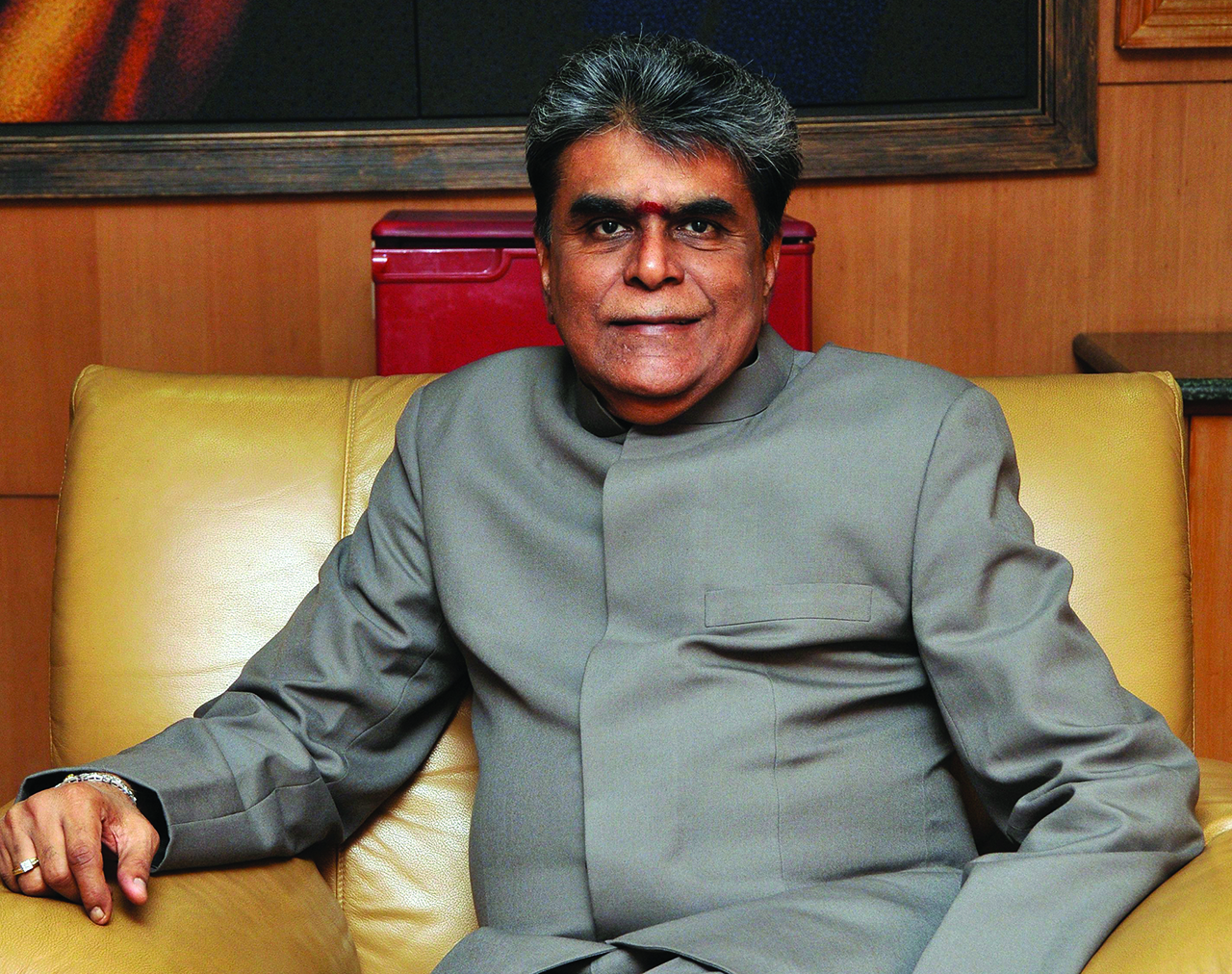

Apparel Export Promotion Council (AEPC) Chairman Dr. A. Sakthivel welcoming the decision says: “I am extremely grateful to Hon’ble Prime Minister Narendra Modi, Hon’ble Finance Minister Nirmala Sitharaman, and Hon’ble Minister of Textiles and Commerce & Industry Piyush Goyal for extending the RoSCTL scheme till March 2024,” Dr Sakthivel said.

“It will refund all embedded taxes and make our products globally competitive. The scheme will go a long way in bringing back positive sentiments and helping the Indian textile value chain attain $100 billion annual exports in next three years,” the Chairman added.

The Chairman of CITI, Mr. T. Rajkumar, also welcomed the decision. He stated that the RoSCTL scheme will help improve the global competitiveness of the textile sector while the key economies of the world are in a reviving mode. The announcement will also give a boost to the objective of “Aatmanirbhar Bharat”, provide a level playing field to the Indian textile exporters and enhance further employment opportunities especially to downtrodden and illiterate women in rural areas.

Sharing similar sentiments, Mr. Ashwin Chandran, Chairman, The Southern India Mills’ Association (SIMA) thanked the Prime Minister, Union Minister of Commerce & Industry and Textiles, Minister of Finance and also the former Minister of Textiles, Smriti Zubin Irani for extending the RoSCTL benefit with the same rates for three more years for garment and made-ups exports. He has said that the industry that had been struggling with the stagnated exports of garments and made-ups for more than four years, started getting good market opportunities in the post-COVID period. He added that the industry could not make commitments and materialize the orders in the absence of RoSCTL benefit and has been facing stress during the last couple of months. Mr. Ashwin has said that the announcement has now given enough confidence and level playing field to increase the exports and create new jobs for several lakhs of people.

Mr. Vineet Agarwal, Chairman of the Associated Chambers of Commerce and Industry of India, (ASSOCHAM) thanked Prime Minister Modi and Union Textiles Minister Piyush Goyal. He mentioned that the RoSCTL scheme would give the textile industry a level playing field, for competing with our neighbouring countries which enjoy duty-free access to the European market.

ASSOCHAM past-president and Chairman of the diversified Welspun Group, Mr B.K. Goenka states that the initiative of RoSCTL would go a long way in establishing India as one the most competitive and reliable sources for textile products and generate employment right across the value chain.