The US is the biggest importer of textile and apparel products. Over the last five years, total textile and apparel imports by the US increased at a CAGR of 0.4 per cent to reach $110 billion in 2016, while its exports decreased at a CAGR of -2 per cent to touch $24 billion. The textile and apparel trade balance recorded a relatively large deficit of $86 billion in 2016.

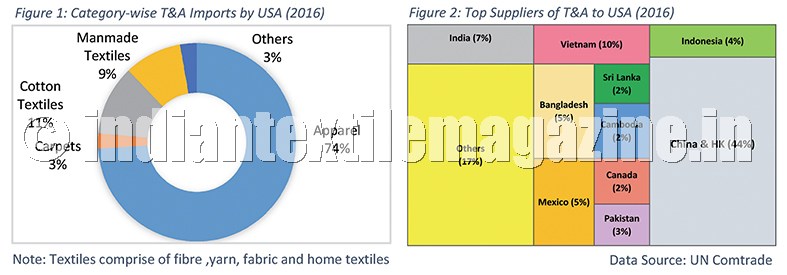

Apparel is the largest imported category by the US, representing 74 per cent of total textile and apparel imports (2016). This is followed by cotton textiles, man-made textile, carpets and others with a share of 11 per cent, 9 per cent, 3 per cent and 3 per cent respectively. Top 10 suppliers accounted for 83 per cent of textile and apparel imports by the US. China is the largest supplier accounting for a 44 per cent share, followed by Vietnam and India with a share of 10 per cent and 7 per cent respectively.

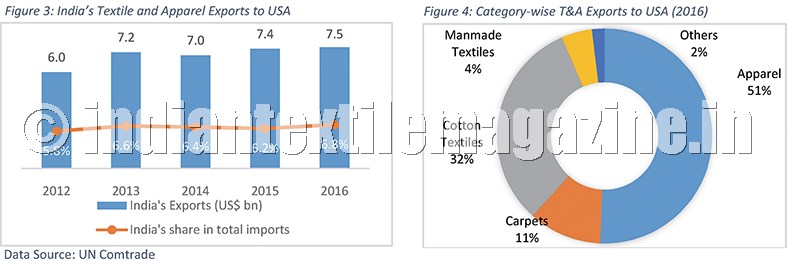

India is the third largest supplier of textile and apparel products to the US after China and Vietnam. India’s exports of T&A to the US stood at $8 billion in 2016. It has grown at a CAGR of 1.1 per cent over the last five years. India’s share has increased from 4.9 per cent in 2011 to 7.3 per cent in 2016.

Apparel is the largest category with a share of 51 per cent in India’s T&A exports to the US. This is followed by cotton textiles, carpets and man-made textiles having share of 32 per cent and 11 per cent, and 4 per cent respectively.

The US is the top market for textile and apparel products with imports worth $110 billion and domestic apparel consumption worth $315 billion. India’s textile and apparel exports to the US have increased by 2 per cent over the last year while the exports from major competing nations, viz., Bangladesh, Indonesia and Vietnam, have shown decline.

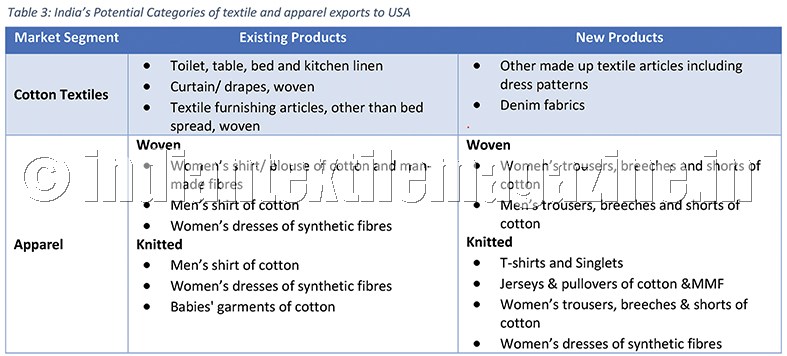

Calling off the proposed Trans-Pacific Partnership trade deal has weakened the prospects for Vietnam, which signals better growth opportunities for India’s textile and apparel exports to the US. India, the largest and more resourceful country of all those listed above is yet to tap the real potential as far as apparel and cotton textiles exports are concerned. India has advantage in terms of manpower availability and infrastructure. Manufacturers need to be ready to undertake suitable investments for product and infrastructure expansion to cater to the demand, which China may no longer cater exclusively.

Calling off the proposed Trans-Pacific Partnership trade deal has weakened the prospects for Vietnam, which signals better growth opportunities for India’s textile and apparel exports to the US. India, the largest and more resourceful country of all those listed above is yet to tap the real potential as far as apparel and cotton textiles exports are concerned. India has advantage in terms of manpower availability and infrastructure. Manufacturers need to be ready to undertake suitable investments for product and infrastructure expansion to cater to the demand, which China may no longer cater exclusively.

For further details, access sanjay@wazir.in

Presented by Wazir Advisors