The textile and apparel industry has witnessed changes in the last few decades. Over the years, a major part of the industry has moved away from developed countries like the US, the EU and Japan to destinations like China, South Asia and South-East Asia. Two most vital variables which brought on this move were the availability of low-cost manpower and abundant of raw material in Asian countries. India, among the Asian countries, is one of the most competitive textile and apparel manufacturing centre today.

Today’s textile and apparel sector is again at the cusp of some major structural changes. The demand pattern is governed by the economic growth of regions, which indicates a slowdown in developed countries while strong growth in China and India. The export growth rate of China has already slowed down, a trend that will lead China to lose some share of global market while still being the largest exporting nation. The opportunity arising because of China’s export growth slowdown can help countries like India, Bangladesh, Vietnam, etc., to increase their trade share. FTAs of these suppliers with major markets of EU, the US and Japan will be of special importance. On the supply side, lack of growth in cotton output will help synthetics to gain share continually. These are some of the mega trends that will impact the industry structure over the next decade.

For the Indian industry, these are specifically interesting times. India stands a chance to gain a prominent market share because of China’s growth slowdown, supporting the Government policies and a strong raw material base. The way that India’s own local request is likewise vast and developing is good to beat all.

Some of these trends are discussed in detail here:

Global apparel consumption will touch $2.6 trillion

The current global apparel market is estimated at $1.7 trillion which forms approximately 2 per cent of the world GDP of $73.5 trillion. Apparel consumption in top 8 economies constitutes approximately 70 per cent of the global consumption. All four BRIC nations appear among the top markets having a cumulative share of approximately 23 per cent. Combined apparel consumption of the US and the EU is 40 per cent while they are a home to just 11 per cent of the world population, implying a very high level of per capita expenditure on Apparel (PEAP) compared to the rest of the world.

An increase in the disposable income of the developing countries would mean that for an emerging or developing market the apparel consumption growth rate would be faster than its economic growth. Based on the projected GDP growth rate and its relation with the apparel market growth, it is projected thatthe global apparel consumption will increase to $2.6 trillion by 2025.

China and India, big market opportunity

China and India have successfully leveraged their large human resource base, low manufacturing costs and large scale infrastructure to achieve a leading position in the world trade. While China has been at the forefront of attracting investments across the sectors, India is also catching up fast. In fact, India replaced China as the largest FDI recipient in 2015. The growing apparel market of China and India are expected to surpass several developed markets representing a significant portion of the global apparel consumption. Despite global uncertainties, the Chinese market grew at 15 per cent annually while the Indian market grew at 11 per cent from 2007 to 2015. This can be attributed to the growing consuming class and continuous growth in the spending power in these two countries.

The present apparel market size of China and India is estimated to be $237 billion and $59 billion respectively. Over the next few years, the combined apparel retail economy of the two majors will represent a significant proportion of the global apparel consumption surpassing several developed markets. Both markets have shown robust growth in the past despite global uncertainties and slack demand. From 2007 to 2015, the Chinese market posted an annualized growth of 15 per cent whereas the Indian market registered a somewhat lower growth of 11 per cent. However, both the markets have performed better than the largest consumption regions (the US, the EU and Japan) where a change in economic conditions led to lower demand growth.

Both the Chinese and Indian economies are expected to maintain high growth rates in the next decade which will be the major driver of apparel market growth in both countries. Studies show that countries after achieving a per capita GDP of more than $2,500 experience a spur of economic growth led by consumer spending. The Indian economy is expected to reach this target by 2020, whereas China is already well past this level.

Apart from economic growth, India’s market expansion is expected to be supported by increasing youth population and high purchasing power, shift from need-based purchase to aspiration-based purchase, urbanization and growth of new retail formats with better reach. For China, the specific demand for kids wear is expected to rise with the abolition of one-child policy. Similarly, demand of outdoor wear and fast fashion categories is increasing rapidly. There is also gradual increase in spending of the Chinese customer from the offline to online retail channel.

All these changes are sure to make the combined market of China and India larger than that of the EU and the US, as shown below:

Growth on the retail front will lead to a trickle-down effect in the local manufacturing value chain benefitting national manufacturers the most. Huge growth will make the domestic market more attractive than exports in many cases for national manufacturers.

Impact of the rising Chinese domestic market

China has dominated the global trade in the last two decades with a share of more than 40 per cent. China is at the juncture now where private consumption is replacing investment as the major driver of GDP growth and will eventually constitute the largest share of GDP. High levels of investment are converting into consumption, creating structural changes in the export-oriented sectors like apparel.

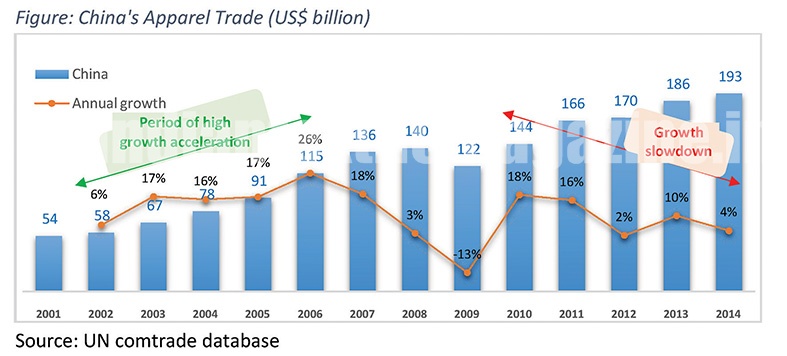

Between 2001 and 2014, Chinese apparel exports increased more than five-fold from $32 billion to $173 billion, growing at 14 per cent CAGR. However, the growth has slowed down in the last few years. From the chart given below, it can be seen that after 2010 the exports growth has slowed down in comparison to the period before the financial crisis where the annual growth was 20 per cent on an average. The trend is expected to remain the same in future.

High growth of domestic demand, wage increase, movement of manufacturing towards more value-added segments and relocation of manufacturing to neighboring countries will cause China’s export rate growth to slow down. However, China with its vast land base, plentiful resources, manpower strength and large manufacturing setup will continue to be the single largest apparel global manufacturer in the foreseeable future. Exports will only slowdown to the extent that China’s domestic market will become increasingly attractive for local manufacturing.

Reduction in the share of China in global exports in 2025 corresponds to a value of $50 billion for which other apparel exporting nations will compete. The beneficiary nations of this opportunity would be those that have competitive manufacturing cost, FTA advantage with key markets, and good export infrastructure. But, the main issue to be addressed would be development of textile capability and scale of manufacturing comparable to that of China. Beyond the productivity, service and product development will be important for filling the void created by China. FTAs with US and the EU will be an added advantage but it is important to note that China thrived without them. None of the top five garment suppliers to the US – China, Vietnam, Bangladesh, Indonesia and India – today have any preferential access to the US. On the contrary, exports from countries in CAFTA, AGOA, etc., have continued to shrink in the last many years. Nations which can benefit most from Chinese growth slowdown include Vietnam, Ethiopia, Kenya, Myanmar, Bangladesh and India, but not necessarily in that order.

Consumption of man-made fibers will grow globally

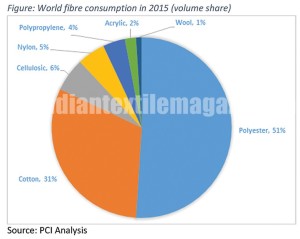

In 2015, the global fibre consumption was around 90 million tons out, of which polyester and cotton had a share of 51 per cent and 31 per cent, respectively. Rest 18 per cent was contributed by other fibers.

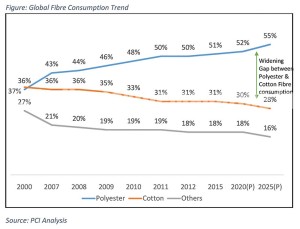

Cotton has always been and will continue to be a crucial raw material to the textile industry, but due to supply side pressure it may struggle to satisfy growing demand in the future. It is expected to stagnate around the current level of 26 million tons over the next few years. On the other hand, the global fibre demand is continuously growing. It is expected to grow at a CAGR of 2.5 per cent reach 115 million tons by 2025. This supply-demand mismatch will lead to an increase in consumption of polyester fibre and to some extent cotton-like fibre, viz., viscose.

Changes in consumer lifestyle like increasing emphasis on fitness, rising brand consciousness, fast changing fashion trends, increasing women participation in workforce and hygiene consciousness are driving the trends in the end products. Impact of such trends is passed along the textile value chain which in turn has resulted in high demand of the fibres that can fulfil these requirements at affordable price. In this context polyester has proved to be the most cost effective and adaptable fibre. As a result, polyester is expected to dominate the global textiles in foreseeable future in almost all end use categories while cotton will slowly lose its share.

Wide acceptance of MMF in end use categories like sportswear, leisurewear, women dresses, home textile, automotive, carpets and other industrial sectors has increased the market demand of manmade fibers. As a result, polyester is expected to dominate the global textile in future in almost all end use categories while cotton will slowly loose its share. The share of cotton will continue to decline from 31 per cent in 2015 to 28 per cent in 2025. During the same period, share of polyester will grow from 51% to 55% implying that by 2025 global consumption of polyester will be almost double than that of the cotton fibre.

FTA will drive trade and investments in the sector

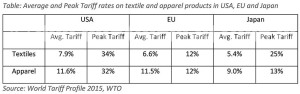

The textile and apparel industry is labor intensive industry. Hence several nations adopt a protected regime by imposing high duties to safeguard the interest of domestic manufacturers.

Key apparel markets like the EU, the USA and Japan have multiple market access arrangements with several key manufacturing nations. They have either entered into different types of trade arrangements or provided special status to certain countries, thereby lowering or eliminating tariff rates. Nations such as Bangladesh, Turkey, Sri Lanka, Pakistan, etc., have emerged as major apparel exporters mainly because of preferential duty access they have to one or more of these markets. In fact, China is the only large manufacturer of textile and apparel which does not have any special market access to the US, the EU or Japan. India has CEPA with Japan, but Indian textile and apparel exports to Japan are insignificant.

FTAs are gaining vital importance in the global textile and apparel industry. The US and the EU have begun negotiations on the Transatlantic Trade and Investment Partnership (TTIP); Trans-Pacific Partnership (TPP) involving the US and 11 other countries has been signed, and India, China, ASEAN nations and four others have initiated negotiations to establish the Regional Comprehensive Economic Partnership (RCEP). These three mega FTAs have the potential to change the global trade and investment flow owing to their cumulative economy size as well as population.

Apart from these mega FTAs, there are other bilateral agreements under various stages of implementation which will impact the global trade and investment flow in textile and apparel sector. For example, Vietnam-EU Free Trade Agreement (VEFTA), which will come into effect from 2018, is expected to boost the Vietnam’s apparel exports to the EU at the expense of other large exporters to the EU like China, Bangladesh, Turkey, India and Morocco.

How to tap the opportunity?

Future opportunity in textile and apparel is beyond question but for businesses to gain market share overall competitiveness will be the key in terms of cost, quality, compliances, logistics, services and product development. Manufacturers have to confront four major challenges:

- Buyers command a strong control over manufacturing value chain

- Low entry barriers lead to intense competition from unorganized players

- National as well as bilateral/international policies have the potential to make or break an entire business model

- Maximum trade is concentrated in price-sensitive commodity business lacking product differentiation

In such a scenario, attaining manufacturing excellence becomes a function of five factors – productivity enhancement, market intelligence, sustainable manufacturing, product and design development and international partnerships.

Productivity enhancement: Productivity enhancement is driven by the demand for higher value at lower price. In general, Indian garment units operate at 40-45 per cent efficiency level, which is lower than their counterparts in countries like China and Turkey which operate at 60-65 per cent efficiency, etc.

Beyond a handful of organized players, the textile and apparel industry majorly comprises of fragmented entities that lack the financial and managerial bandwidth to identify, analyze and rectify productivity related challenges. Fragmented nature of industry, management mind set, lack of best practices & technical knowhow and higher attrition rate are some of the major reasons which are responsible for this position.

In an apparel factory, productivity improvement can be achieved by focusing on all entities of a manufacturing ecosystem- manpower, machine & material and capital. The key components of what is referred to as ‘Factory re-engineering programme’ are production planning & control, systems and processes at shop floor, workforce training, factory layout planning and use of work aids. At a country level, presence of efficient firms would increase India’s overall image in the world market attracting larger orders and also enhance wage earning opportunities of the workforce.

Market intelligence: Market intelligence forms an important part of growth as it helps the businesses to figure out the upcoming high traffic products and customers. It helps companies take decisions on taking the right move like entering into a new market, innovative designs, product expanding an existing business, establish a distinctive identity or marketing around customer needs.

Every product has a life cycle – innovation, introduction, growth, maturity and decline. All businesses that have product specific profiles face a similar maturity when the product is in its decline phase. To maintain the profitability of business, product extensions or brand innovation becomes important. Thus, identifying the right product at right time can help companies build their distinctive image. For example-the women’s bottom wear leggings entered the Indian market just a few years back but gained quick acceptance and has turned into a Rs. 800-crore market.

Hence, it becomes important for any business to continuously track global and domestic trends and T&A is no exception. However, Indian T&A companies at large are yet to appreciate this aspect and establish such systems in-house.

Sustainable manufacturing: Environmental and social compliances are no more optional. The general motto these days is “Compliance first, Business next”. Any large buyer before selecting a supplier ensures that all the compliance aspects are met by the factories. Any failure in these aspects are a strong ground for rejections.

Product and design development: Product development has become an inevitable part of business development. It involves modification of an existing product, or formulation of an entirely new product that satisfies a newly defined customer want or market niche by offering additional benefits. Businesses need to assess the gap in market and come up with new or improved products to stay competitive in the market. A successful product development strategy can help businesses increase revenue and gain profitability.

International partnerships: Many companies have started exploring potential tie-ups or joint ventures with international players, be it for manufacturing, marketing or brand licensing. Such collaborations help the company upgrade in terms of skill sets, manufacturing capacity, design and operational efficiency as they get an access to the partner company’s valuable resources including market foot-print.

Wazir Advisors is a premier Indian management Consulting firm focused exclusively on 2 sectors – textiles (Fibre to Fashion) and retail. In our sectors of expertise, we have worked with who’s who of the sector. Our services are directed towards helping Clients identify new areas for growth, market entry, JVs, location analysis, sector mapping, investment promotion, process re-engineering, productivity improvement, and skill development.

The author can be contacted at sanjay@wazir.in

By Sanjay Arora & Vini Pargain, Wazir Advisors Pvt. Ltd.