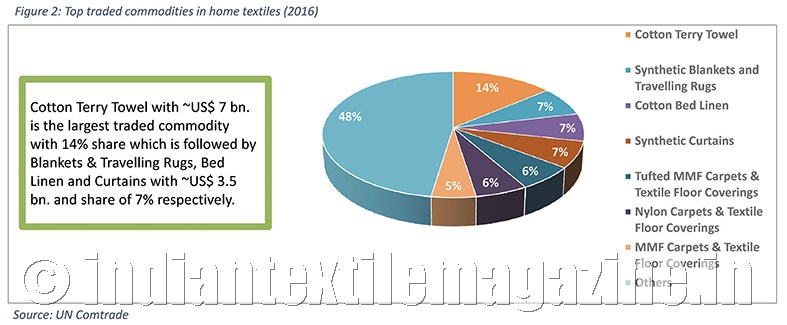

Home textiles, a major segment of the overall textile industry, offers a wide range of categories such as furnishing fabrics, curtains, carpets, table covers, kitchen accessories, made-ups, bedspreads, bath linen, and other home furnishings. The US and Europe are the biggest consumers constituting 60% of the home textiles imports, while nations like India, China and Pakistan are among the key suppliers. Carpets form the largest sub-segment in home textiles, followed by bed linen.

In 2016, global textile and apparel trade stood at $743 billion, while the share of other categories such as fibre, yarn and fabric has decreased. Home textiles has maintained its share of 6% over the past five years.

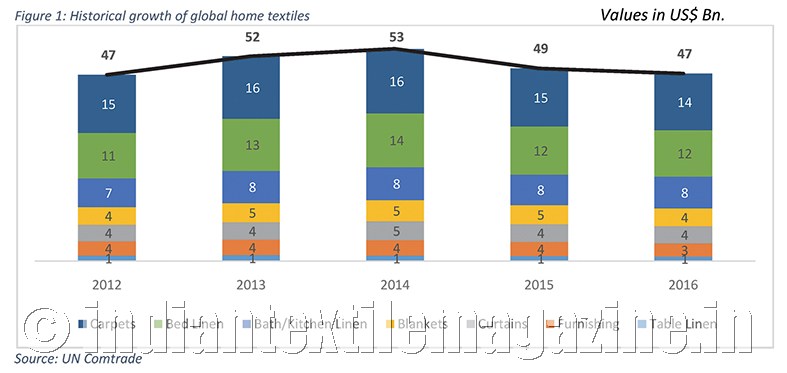

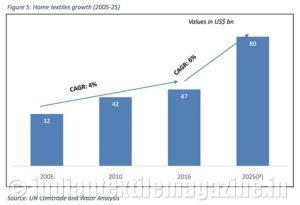

In 2016, the global home textiles trade amounted to $47 billion, and it has been growing at a CAGR of 0.2% since 2012. Carpets were the top traded category valued at $14 billion. While table linen, furnishing and carpets have been growing at a negative CAGR of 5%, 2% and 1% respectively, bath / kitchen linen has shown the maximum positive CAGR of 3% and an increase in share of 1% too.

Growing exports to markets

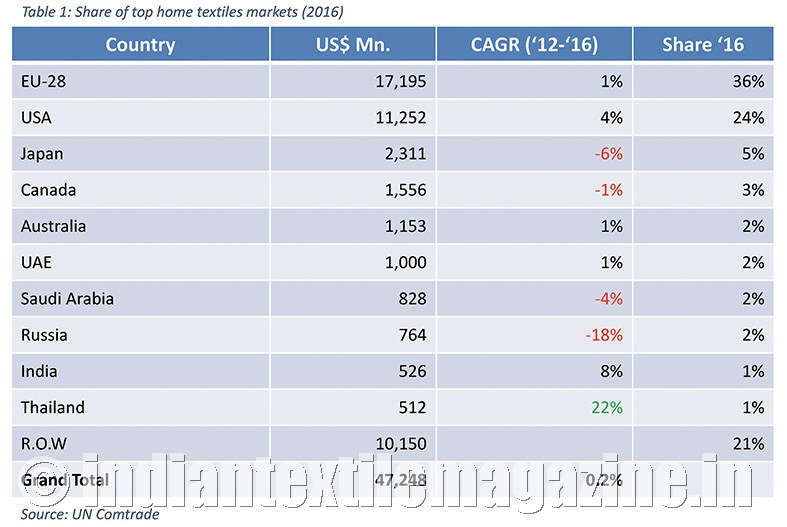

The top 10 importing nations contribute to about 80% of the home textiles market. EU-28 is the largest market for home textiles with a share of 36% and import value of $17 billion. This is followed by the US with import value of $11 billion and a share of 24%. Japan, Canada, Australia, the UAE, Saudi Arabia, Russia, India and Thailand constitute the top markets for global home textiles.

Thailand has emerged as a market for home textiles in the last five years with a CAGR of 22% but at a small base value. Japan being the third largest market for home textiles is declining with a CAGR of 6% over a period of five years due to economic downturn and demographic issues. Russia, facing similar issues, has shown a downfall of 18%, thus losing ranks in the list of major markets but is expecting some growth going forward.

Thriving Asian suppliers

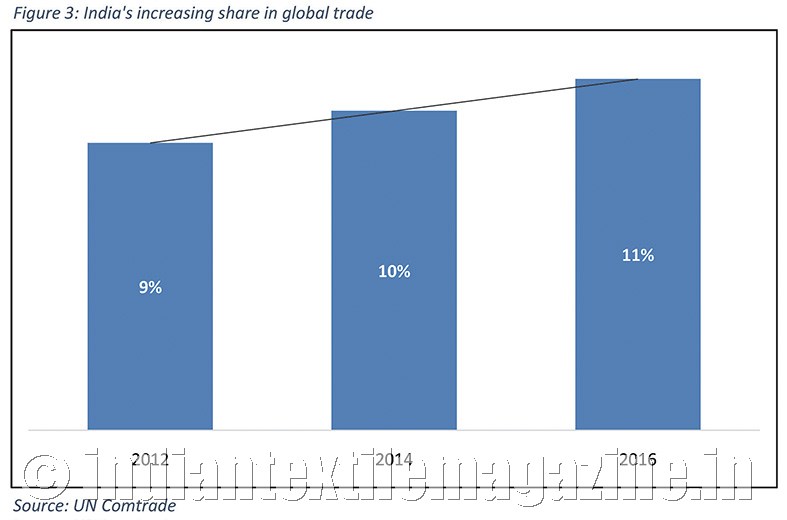

The top 10 suppliers – China, India, Turkey, Pakistan, Belgium, Germany, Netherlands, the US, Portugal and Poland – have 80% share in world’s major suppliers. China has the maximum share at 39% with $18 billion, followed by India at 11% with $5 billion.

Poland has emerged as a supplier of home textiles in the last five years with a CAGR of 4.6% but at a small base value. India, with growth rate of 4%, has increased its world share from 9% to 11% in the past five years. China has remained almost stagnant with a CAGR of 0.2%, while countries such as the US, Belgium and Germany have a negative growth rate.

The booming Indian trade

India is widely perceived and acknowledged for its variety and exquisite designs in home textiles. The current Indian home textiles market is in a sweet spot as India’s share in the global exports continues to increase, furthering penetration into major markets.

India is not only one of the biggest suppliers but also one of the largest consumers of home textiles. Major players such as Welspun India (the third largest towel producer), Trident (the largest terry towel producer) and Dicitex (the fifth largest furnishing fabrics producer) are based in India. These companies cater to both international and domestic markets.

Indian markets and growth prospects

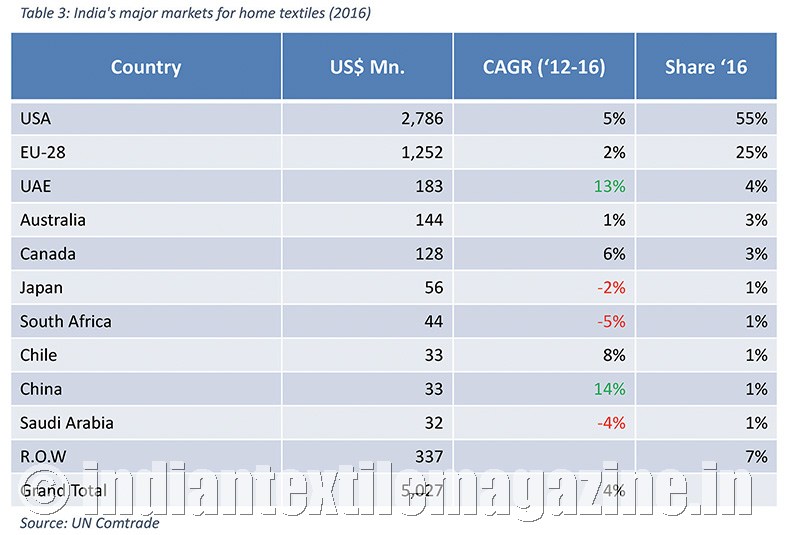

Home textiles exports from India have been expanding in major markets, including the US and EU-28. Out of the total US imports, 25% are from India. A major growth trend is visible in the UAE with a CAGR of 13% from 2012.

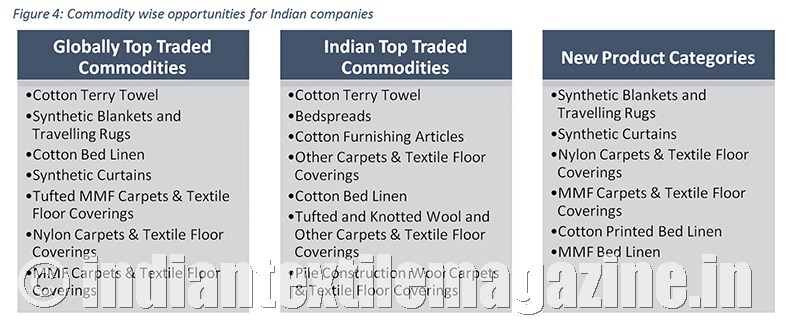

China is increasingly importing home textiles from India, especially curtains (18%), blankets (18%), carpets (16%) and bed linen (17%). Similarly, the UAE has also emerged as a significant market for Indian home textiles with carpets having a 58% share. This may be attributed to the traditional carpet weaving industry in India that has a niche in manufacturing carpets and furnishing.

There has been a structural shift in the dynamics of the global home textiles trade as Indian companies have gained advantage over the Chinese counterparts. Indian companies have become competitive in the home textile exports market, leveraging the gap created by the rising labour cost in China and availability of raw material. Also, Indian organizations are cost competitive due to economies of scale, world class manufacturing facilities, product innovation and quality.

Trends driving the future global growth

Soaring demand for household products and growing consumer awareness have made home textiles a lucrative business segment in the global textile industry. Various growth drivers are pushing this demand to an all-time high.

One of the major factors driving growth is the flourishing home textiles market in the Asian economies such as China, India, Thailand, etc. Though the major consumer base still exists in the US and European markets, an increasing trend of household purchases is also visible in these Asian economies due to a flourishing housing market and the rapidly growing middle class.

Secondly, fashion sensitivity towards household furnishing has increased as fast-fashion has hit not only the apparel market but the home market as well. Home fashion has become a separate segment as consumer consciousness towards high quality living has increased.

To cater to the increased demand, the number of retailers entering the home textiles market is also increasing. From IKEA to H&M Home, big brands are entering the thriving market to tap the big opportunity and take advantage of the prevailing environment.

Moreover, the advent of E-commerce in the segment is further making the market even more competitive, and with the increasing number of websites, the marketplace is also experiencing growth.

Fuelling the market growth, research and development in the home textiles segment has been immense. Modern lifestyle involves a lot of stress and sleep deprivation, and thus innovation in sleep technology and finishes such as microbial, anti-mist, herbal, etc., are the future of home textiles.

It can be readily said that going forward the home textiles trade will grow at a rate of 6%. Further, the home textiles segment has become increasingly competitive, and only cost-driven organizations delivering product quality and customer satisfaction can survive in this cost-driven market scenario.

By Sanjay Arora, Vini Pargain & Vanshika Jain, Wazir Advisors Pvt. Ltd.