“India is ranked among the Top 3 markets worldwide for the Picanol Group. We will continue investing on expanding our sales and service infrastructure in the country” – P. KasiViswanathan, Head of Indian Operations, Picanol India Private Ltd.

The going has been really good for Picanol India since its commencement of operations in the country four years ago. In fact, the company’s business in the country has expanded consistently over the years, thanks to its continuous innovation in products and services and the strong relationship that team Picanol has established with its customers. With over 15,000 Picanol machines operating across India, the company has clearly emerged the leading supplier of weaving machines to the Indian textile industry.

Spearheading much of Picanol’s growth in India is the dynamic sales team headed by Mr. P. KasiViswanathan, Head of Indian Operations, Picanol India Pvt. Ltd. In an interview to The Textile Magazine, Mr. KasiViswanathan spoke in detail about the company’s growth story so far and the future expansion strategy.

Spearheading much of Picanol’s growth in India is the dynamic sales team headed by Mr. P. KasiViswanathan, Head of Indian Operations, Picanol India Pvt. Ltd. In an interview to The Textile Magazine, Mr. KasiViswanathan spoke in detail about the company’s growth story so far and the future expansion strategy.

Excerpts:

Textile Magazine: How was the year just gone by for the Indian economy, particularly the textile sector?

KasiViswanathan: Well, a lot happened in 2011, mostly negative in nature. The Indian currency was devalued to the extent of 19 per cent as compared to 2010. Though partly attributable to local conditions, the European debt crisis and the US slowdown mainly accounted for the FII pull-out from the stock exchange (capital market). More than 60 per cent of the Indian stock exchange transactions revolve around FIIs. The Sensex went down by 25 per cent in the last 12 months. This was probably in line with the fall in other Asian countries. The index in China was down by 21.7 per cent, Hong Kong 20 per cent and in Japan by 17.3 per cent. However, the US market was higher by six per cent. The strength of the US dollar against other major currencies also pulled INR down. Overall exports from India were at a two-year low. On the other hand, I am surprised that the weak INR is not seen as an opportunity for Indian textile exports, as raw materials and labour (major cost components in textiles) are sourced locally in INR and thus offer lower cost compared to China where the currency has been strengthening against both the Euro and the dollar.

Let us hope the new initiatives like allowing foreigners to invest directly in Indian stocks would attract more foreign funds, reduce market volatility and stabilise the Indian capital market. Local conditions are no better either. Factors like high interest rate (RBI revised the interest rate seven times in 2011 alone to control inflation which remained high at 9-10 per cent), rising fiscal and current account deficit, slow decision making due to political compulsions, etc., had their impact on all industry sectors, including textiles. Even though, of late, the textile market is most domestic market-oriented as compared to the condition obtaining some 10 years ago, we need to focus on the export market mainly for earning valuable foreign exchange.

Restoration of TUFS for the textile industry and the additional benefit of 10 per cent capital subsidy for new weaving machines were of course welcome signs.

TM: Picanol has completed four years of its operations in India. How was the journey so far?

KV: A pretty good and smooth ride, I would say. Our focus was very clear when we started our operations. Picanol India started as a small set-up with three offices, one each in Delhi, Mumbai and Coimbatore. Today we are functioning as a complete team with sales, service and print repair shops capable of fulfilling the needs of individual customers all over India. We have also developed a separate team to take care of customer requirements of spares & accessories, etc.

TM: How successful were the company operations in India in the last four years?

KV: Setting up of the Indian office made a lot of difference to the company customers. They are indeed happy with the decision to set up the Indian office with a dedicated sales & service set-up. Each regional office is self-sufficient, in the sense that it is equipped with adequate manpower to promptly attend to sales and service calls. By making frequent visits to customers, the rapport with them is getting better, making it easier to understand the market trend. We could also explore more and more new markets during the four-year period.

TM: How many Picanol machines are currently in operation in India and how many market locations? Please name some of the leading company customers and the major projects that you’ve executed for them so far?

TM: How many Picanol machines are currently in operation in India and how many market locations? Please name some of the leading company customers and the major projects that you’ve executed for them so far?

KV: We have more than 15,000 machines running all over the country, covering organised and mid-segment market areas like Ichalkaranji, Bhiwandi, Bhilwara, etc. Almost all major textile groups in India have installed Picanol weaving machines. Some top customers are Bombay Rayon, Alok industries, Vardhman Textiles, Nahar Industrial Enterprises, Bharat Vinay Mills, LNJ Denim, NSL Group, etc.

TM: Can you throw some light on the weaving segment of the textile industry in India ñ the market size, the growth witnessed in the last few years and the major players in the segment?

KV: At the moment, weaving is only in its formative stage as compared to spinning. There are now only a handful of textile units with integrated plant facilities for spinning, weaving, processing and knitting. Though the opportunities for conversion from spinning to weaving are enormous, it is difficult to predict the market size as the growth of the weaving segment would depend on many factors.

A large number of spinners can go for value addition, which implies opening up of the weaving market. Most powerloom units are getting themselves ready for modernisation. With policy support from the Government to go in for new machines with 10 per cent capital subsidy, the mid-segment markets will prefer new machines to imported second-hand machines. With the ongoing modernisation, even corporates from the organised sector would replace even 10-year-old machines with new ones.

TM: What are the brand weaving products and solutions offered by the company in the Indian market? What is its current market share?

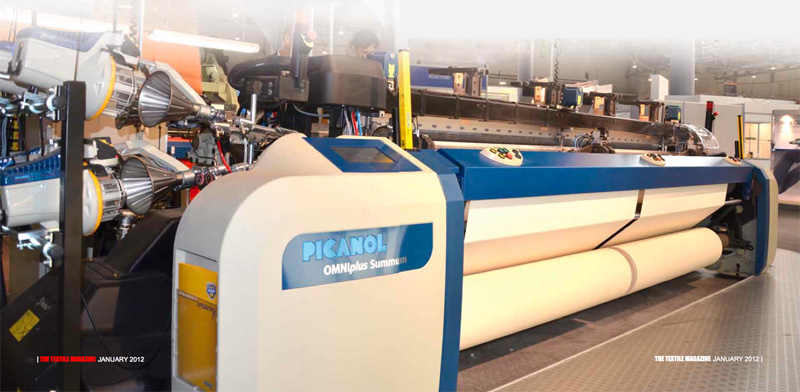

KV: Thanks to our loyal customers and the repeat orders from them, we enjoy a leading market share in airjet and rapier technology. We released our latest airjet technology, OmniplusSummum, at ITMA 2011 in Barcelona and are happy that the product attracted most customer attention at our booth. Basically we focus on lower consumption in order to reduce the cost of operation for the customer, higher speed, use of the latest hardware & software technology for our control station, etc. The star attraction among the weaving machines was the OmniplusSummum. We also released the new Rapier loom OPTIMAX with its potential for 540 cm wider width looms, as well as a positive guided gripper version, aiming at extending our range of applications in technical textiles. We have a major market share in both these technologies as proved over a period of time.

TM: How prompt and efficient is your after-sales service? Any special initiative which you would like to highlight in this regard?

KV: Our talented service team is a blend of youth and experience. The aim is that, with Picanol looms, new or second-hand, the customer should be able to get the best out of our machines. We can extend our expertise not only with regard to installation, regular servicing and in-plant training, but work with customers on performance enhancement program by which our team would jointly work with the customer team to accept the challenge of increasing the efficiency of loom shed and enhancement of the quality of the preparatory department.

We continue emphasising the role of ìoriginal Picanol sparesî on our machines, as this is the best way to safeguard the value of our customers’ investment. We even offer several weave-up or upgrade packages by which we offer our customers the opportunity to take advantage from innovations on new machine types without having to invest in a completely new machine. Some of the packages such as Cordless, Airmaster, ARVD+, LDEC System, etc., have attracted customer attention worldwide.

TM: How will be the New Year for the weaving industry in general, and Picanol in particular?

KV: Customers focusing on fabrics designed to meet local demand will have an edge over the others. This is true considering the wide currency fluctuations and an uncertain export market due to the European debt crisis and the reduced demand from the US. In this context, I feel there will be greater demand for denim fabrics in India. This segment, with enormous potential, keeps growing year after year. You will also see India emerging soon as a leading global producer of denim fabrics. Yet another growing market is for shirting, followed by terry towel and sheeting. Though the latter is at present export-oriented, it will attract equal domestic attention over the next few years.

TM: In the current uncertain economic scenario, what would be the factors driving demand, particularly for textile products?

KV: The weakening of the Indian rupee is of major concern for everybody (though, as said earlier, in my opinion this is an opportunity for Indian textile exports). Added to this are the gradual decline in overall industrial output and withdrawal of FIIs from the financial market. However, I am sure that India, an emerging Asian industrial power with its vibrant economy, will once again set an example by leading an economic revival from the current slowdown as it did a couple of years back by being the first to come out of the worst-ever global recession of 2008. What is needed is political stability and quick decision making. All eyes are on the forthcoming Budget, as well as the expected positive signals from the European Union and the US.

TM: Are you planning any new product introduction in the emerging situation?

KV: No. Since we utilised ITMA 2011 at Barcelona as the launching pad for several new machine models, we are sure the current year will witness surging demand for such sophisticated products, particularly OmniplusSummum which was the star attraction at the show, and the gradual market introduction of Optimax in wide and positive execution in the growing technical textiles segment. In brief, we are just assessing the market for the new products launched at the exhibition.

TM: How important is the Indian market for Picanol, and what are the future growth and expansion plans?

KV: India is always ranked among the Top 3 for the Picanol Group. We will continue investing on expanding our sales and service activities in the country. Further, we will accelerate the expansion programme depending upon the achievements made in the next three years. Since, at the moment, weaving is getting top priority, we would like to see more value addition at the mid-segment market as well.