The global textile and clothing industry has been witnessing a big change over the past couple of years. There are typical reasons for this change. One, the rate of GDP growth of all major consuming economies, except China and India, has been and will continue to be less than five per cent.

The global textile and clothing industry has been witnessing a big change over the past couple of years. There are typical reasons for this change. One, the rate of GDP growth of all major consuming economies, except China and India, has been and will continue to be less than five per cent.

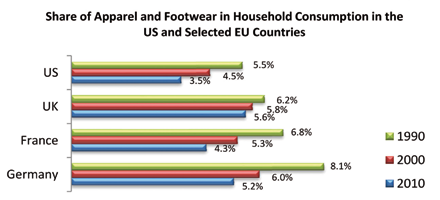

Also, the continuing recessionary pressure has been affecting consumption in the EU and the US resulting in a steady decrease in the wallet share of apparel & footwear.

The recessionary sentiments will continue to put pressure on retailers who have been trying hard to attract and retain customers by bringing in changes in the overall product proposition and trying new and somewhat radically different things.

In China and India, however, the per capita consumption of clothing has been on the rise and has almost doubled over the past 10 years. So, generally speaking, while the global apparel market is expected to grow at four per cent, China and India can potentially grow at the twice that level.

However, in 2012, the domestic market in India has seen a mixed trend. While sales picked up reasonably in the first quarter, the overall level dropped towards the middle of the year. While the key growth driver in the earlier part of the year was the increase in price, the slowdown in demand towards the middle of the year led to a significant increase in inventory levels. Most retailers in India started the sales early this year to attract consumers and thus try to reduce inventories.

The overall sentiment continues to be encouraging, and it is expected that both domestic and international retailers will continue to expand in India, albeit cautiously. There might be some cases where the international retailer has not been able to get the right format and will have to redefine the retail structure for India.

In India, typically, multi-brand outlets have seen better conversion ratios than standalone stores, which give a perception that the consumer is looking for wider variety rather than going after brands alone.

New retail channels were also quite talked about in 2012. E-commerce businesses showed a significant growth in terms of interest in India. Most of the e-commerce websites which started last year offer fashion merchandise of various brands and private labels. Others that did not offer fashion apparel started looking for a category to sell. From a consumer perspective, fashion products make a good sense on websites. One can look at a greater variety of products without having to travel to various retail outlets. The price is not prohibitively high for the consumer to be able to buy online and with attractive return policies being offered by most of the e-businesses, the overall proposition becomes very attractive.

On the textile side, India has been able to redefine the model and most businesses have been able to grow. Some attractive government initiatives like TUFS have also become key motivators for the growth of the textile industry in India. The substantially large cotton base, coupled with attractive policies at both the Central and State Government levels, will help private companies to take their overall numbers to the next level.

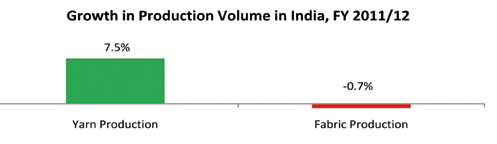

In fiscal 2011-12 (April-March), yarn production increased by 7.5 per cent and fabric production decreased by a moderate 0.7 per cent compared to fiscal 2010/11.

While the growth of the domestic market contributed positively to the manufacturing sector, the fluctuations in raw material prices and slowing of demand from export markets had a negative impact on manufacturing. Even with the above attributes, most of the textile companies have shown positive growth in revenues and profit in 2012. The average sales growth of the top-listed textile companies was 17 per cent in the first half of 2012 compared to the prior year. This growth can be attributed to higher price realization and domestic market sales.

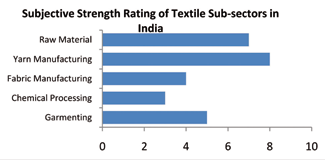

However, there are still issues with the overall supply chain capability. While the spinning sector has the largest capacity in India, the weaving and processing sectors have been neglected.

There is a need to improve the overall capacities of the weaving and processing sectors in India. The previous year also saw issues on compliance take centerstage with most units in Tirupur closing down at one point of time due to pollution-related issues. This is a major concern and will need to be addressed over a period of time. Most businesses feel the cost of running an ETP to be an additional burden on the overall cost and try to find shortcuts.

Apparel manufacturing for the export market did rise in Indian rupee terms due to the appreciation of the dollar. In volume terms, it might have remained the same or would probably have seen very little growth.

The typical manufacturing geographies of apparel manufacturing are becoming expensive. Labor is also short in supply, and a lot of exporters have resorted to either starting dormitories or moving out of bigger cities, if not both. Internal efficiencies are becoming more vital and most companies will have to look at reducing wastage across the entire manufacturing value chain.

The probable advantage due to shift in orders from China, because of increasing wage rates in that country, which looked attractive at one point of time, could not be realized by India. The shift in the customer product mix from cotton to synthetic fibers also adversely affected the order books with Indian suppliers who have always been working with cotton-based garments.

As we get closer to 2013, the optimism for the textile and clothing industry continues. The domestic market is expected to grow further with higher penetration into Tier-II and Tier-III cities. The year 2013 should also see more international brands consolidating their plans to enter India either directly or through local partners. This will increase the potential for growth in India’s textile and apparel manufacturing capabilities. Investment in textiles will continue to grow in States like Gujarat and Maharashtra which have brought out aggressive textile policies.

The core drivers of growth in the textile and clothing industry in India remain intact and are expected to lead to the industry taking bigger leaps in 2013.