The most exciting space within the entire sports and fitness world has been emergence of ‘Activewear’. Unlike sportswear, activewear can be worn anywhere since it is also more flexible in style. Brands have started blurring the distinction between sports gear and activewear. Today this category of garments find usage in gyms, to a casual day out and even work places, hence aptly called ‘athleisure’.

As per Statista.com, the combined value of the global sports apparel and footwear markets was $285.7 billion in 2018, with the apparel market accounting for $155.2 billion of that total. The expected CAGR for period 2010 to 2023 is 6.7%.

Post-Covid market scenario

The pandemic changed ‘The Normal & The Norm’ of our world; it has disrupted market forecasts and business viability.

In this context, a category worth appreciation within textile industry is Activewear(apparel) which has exhibited strong & sustainable trend in the face of adversity. Some encouraging reports from around the world:

• Forbes [Jun 10, 2020]:

According to McKinsey’s State of Fashion report, the industry overall is likely to contract by 27-30% in 2020 compared with the 2019 baseline figure. Meanwhile sportswear, activewear, and loungewear are emerging as the winners in this tough battle for survival. Sales of activewear in the US and the UK were up 40% and 97% respectively during the first week of April, according to retail analytics company Edited.

• ET Retail [July 13, 2020]

NorthAlp, an online shopping portal that exclusively focuses on sports activewear and fitness gear segments, has seen a 300 per cent increase in sales. Revealing figures, the company highlighted that during the lockdown period, 40 per cent of its sales were for activewear, 30 and 13 per cent for yoga mats and footwear, respectively, followed by fitness accessories.

Fitmoda, a women’s activewear e-commerce store…. “Our online sales of activewear have almost grown by 100 per cent, about 70 per cent of our total sales were for fitness activewear by women below the age of 35 years.” Break-up of the total sales of activewear at Fitmoda comprises tops (50 per cent), bottoms including leggings, skirts and shorts (30 per cent) and jumpsuits (20 per cent).

INDIA MARKET OPPORTUNITY

Activewear market in India is growing the fastest among Asian regional markets. Indian consumer preferences have also evolved with the dynamic lifestyle, attention has shifted from a pure athlete-related concept to a transitional usage from gym to casual outing. This has led to development of a very attractive market that’s growing exponentially and not limited to traditional sports brands but a play for every fashion brand worth its salt.

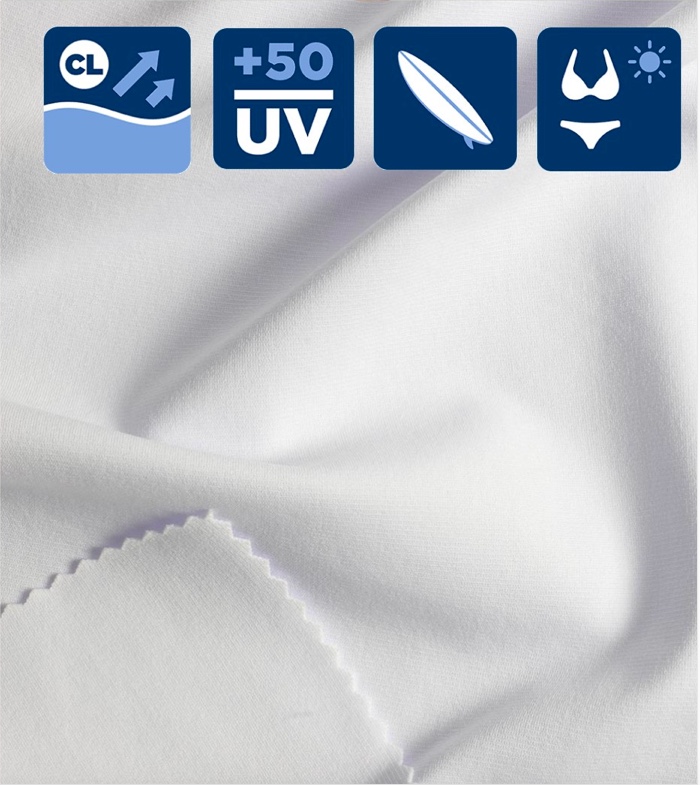

Functionality is an important attribute of the fabric used to manufacture Activewear. The fabric provides unique properties that help the user in ‘active zone’ – stretchability, moisture wicking, anti-microbial, anti-odour, anti-UV, temperature regulation, compression etc.

Fabrics used for Activewear garments could be Circular knitted, Warp knitted or Woven, using fibres like polyester, nylon, polypropylene, Tencel, neoprene and certain proprietary fibres, with or without spandex. The use of cotton and its blends in Activewear has been diminishing over the years.

A. Woven Garments: Jackets, Wind-cheaters, Shorts, Outdoor legwear

B. Warp-knitted Garments: Track suits, Jackets, Tear-proof designs, Swim suits

C. Circular Knitted Garments: Yoga pants, Leggings, Joggers, Capris, Shorts, Long Tops, T-shirts (for multiple usage), Crop-tops, Hoodies, swim suits.

It is evident that Circular Knitted fabrics form a major part (about 70 percent) of activewear offering from all major sports & athleisure brands. Nearly 65 percent of all garments by major sports brands are imported for meeting India market demand. Despite a reasonable capacity of garment manufacturing, the unavailability of adequate functional fabrics has discouraged the garments from picking up orders for activewear manufacturing.

Market size for synthetic cirucular knitted activewear fabrics

Sportswear segment has one of the highest projected CAGR in Indian textile industry at about 14%. During the years from 2015 to 2018, the growth of sportswear market in India has been at CAGR of 22%. Based on the recent & projected growth rate, the market size in 2019 would be closer to ₹65,000 Crs (~US$9Billion). This market size includes garments, shoes and accessories.

An independent research built on the financial performance (FY 18) of leading MNC sports brands, MNC Athleisure brands and Indian Sportswear brands, indicate that retail value (stores & online) of activewear garments is Rs. 18,400 Crs. This excludes the unorganised market valued at about Rs. 36,000 Crs. that utilises cheaper quality of fabrics.

The derived value of fabrics from the retail value of sportswear garments is Rs.1100 Crs, which translates to demand of 31,430 tonnes per annum. The share of demand for synthetic circular knitted fabrics is about 22,000 tonnes per annum [in FY 2018].

Demand: The manufacturing capacity required to produce synthetic knitted fabric to meet domestic demand is about 63 TPD [in FY 2018]. The sportswear brands have been growing at 12% to 20% y-o-y over the last 5 years, hence current domestic demand for synthetic knitted fabric is about 80 TPD.

Based on the interactions held with Product & Procurement Heads of select group of leading sports brands in 2018 & 2019, the demand for circular-knitted sportwear fabric was calculated at about 25 tonnes per day (TPD). This data is well corroborated with the demand estimation approach from retail sales.

Supply: The domestic production is only about 15 to 18 TPD by small manufacturing units with capacity ranging from 1 to 5 TPD. In many cases, the synthetic circular knits are produced by units that are primarily engaged in cotton knitting. Hence there is a huge market potential for the supply as bulk of its demand is met by imports from China, Taiwan, Thailand, Indonesia etc.

Imports: As per the import statistics for the year 2019, the value of knitted fabrics with spandex percentage of 5% or more [Knitted or crocheted fabrics, of a width > 30 cm, containing by weight >= 5% of elastomeric yarn or rubber thread (excluding pile fabrics, incl. “long pile”, looped pile fabrics, labels, badges and similar articles, and knitted] is $62.77 million or 7046 Tonnes in quantity. Majority (about 90%) of these fabrics are likely to be synthetic since large quantities of good-quality cotton-based knits are produced in India which is exported world-wide.

This import quantum translates to about 6340 tonnes per annum, equivalent manufacturing capacity of 18 TPD. It can be inferred that lot more quantity of sportswear fabric is imported under different HSN codes to meet the demand.

There is also immense potential for exports of sportswear garments from India, which has remained insignificant due to unavailability of local supply of fabric and trims. Much smaller countries like Vietnam, Cambodia, Sri Lanka and now Bangladesh are exporting sportwear worth billions of dollars. Based on interactions with major garment manufacturers – Brandix, MAS Group, Hirdaramani, there is an addressable market in Sri Lanka of about 100 TPD for circular-knitted sportwear fabric. Bangladesh is another export market that has a demand for about 45 to 50 TPD of circular-knitted sportwear fabric.

Business Opportunity

There is a clearly identified & immediate business opportunity to set up a dedicated circular knitting unit to produce activewear fabrics with a capacity of about 6 to 8 TPD, that can be scaled to 20 TPD unit in next 5 years. The key success factors for the business unit are product innovation, world class product quality and agile manufacturing. Specific incentives & subsidies are provided by many states under respective Textile policies for technical textiles. The scope of business is not limited to growing Indian market, but can cater to Sri Lanka and Bangladesh that have an existing combined demand of twice that of India.

Mr. Manoj John has two decades of experience in business advisory, assisting companies to identify growth opportunities for investment, prepare feasibility studies & business plans, lead project implementation task force, and establishing business partnerships. He can be reached at reachmj@yahoo.com/9322381900/https://www.linkedin.com/in/manojjohn/