Mr. Sanjay K. Jain, Chairman, CITI, has expressed his disappointment over the announcement of substantially reduced duty drawback rates by the centre for the entire textile value chain. He stated that the entire textile value chain is already suffering due to poor export performance due to high tariffs in most of the exporting countries, preferential trade agreements with EU and USA, better tax systems in textile competing countries, etc. He further stated that after agriculture, textile is the only largest employment provider to the country which provides jobs not only to skilled, semi-skilled, illiterate people but also to the large scale marginal farmers who work on fields including poor independent women who have no other employment opportunity except textiles.

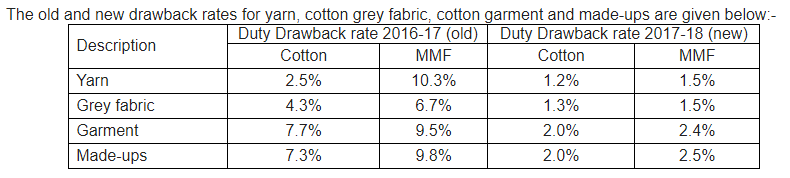

Mr.Jain stated that centre should have taken into consideration while announcing duty drawback rates that textiles’ exports has been stagnant since last three years around USD 37 bn. The announcement is a severe blow to the industry which is already reeling under various critical issues for its survival. He further stated that the inordinate delay in refund of GST to the exporters who have shipped their consignment in July is a great cause of working capital issue. He stated centre, last year, had announced a special package for garments and included made-ups giving enhanced duty drawback rate and also ROSL (Refund of State Levies). However, the present announcement of the government on duty drawback rates does not synchronize with the earlier announcement of boosting exports and job creation. In the present announcement, only the old drawback rates have been retained when Cenvat credit was availed without any change and also without getting into detailed calculation of blocked tax burden on each product.

The CITI chairman further stated that the industry was earlier enjoying exemption route, drawback benefits and other export benefits which helped industry gain competitive edge over its competing Nations. However, Bangladesh, Vietnam, Cambodia, etc. have achieved significant growth in garment exports during the last few years while Indian export is stagnated at US $ 16 to 17 billion per year. Mr. Jain further reiterated that the government should immediately re-draw drawback rates applicable for textiles, refund all the blocked, embedded taxes, levies and accumulated input tax credit on fabric especially the processed fabric. He further stated that the cost of dyes and chemicals accounts 30 to 40% of the processing charges. Dyes and chemicals attract 18 or 28% GST making 3 to 5% accumulation of input tax credit as the fabric or processing job work attracts only 5% GST. He added that the service tax has been increased 15 to 18% and several services have been brought under tax net under GST.

Mr.Jain felt that at yarn stage the actual drawback rate would work out to 2 to 2.5% and at grey fabric stage, the same would work out around 3% while at finished fabric, garments and made-ups would work out to more than 5%. The exports will suffer very seriously and dwindle down sharply. He suggested that the Government must ensure that no taxes are exported and to protect the jobs of several millions of people in the textile industry. Mr. Jain has urged the Government to extend the existing drawback benefits till the GST anomalies and problems are fully sorted out and also the realistic drawback rates refunding all blocked, embedded taxes and levies including accumulated input tax credit at fabric stage are fully taken into consideration.